Welcome to the GUK Magnetics January Market Update. This update provides an overview of key developments, helping you stay informed and prepared for whatever the market brings.

Make sure to subscribe to our monthly newsletter to receive the latest update in your inbox each month.

Trade Policy: Navigating the Rare Earth Window

The temporary suspension of strict rare earth export controls (now extended until November 2026) remains the dominant strategic opportunity for the tech and automotive sectors.

Inventory Front-loading: January is the prime month to finalize large-scale procurement of Dysprosium, Terbium, and Gallium. UK manufacturers are advised to secure Q2 and Q3 requirements now to avoid the February logistics blackout and potential policy shifts later in the year.

Despite eased licenses, “Dual-Use” documentation is being audited with 100% frequency.

Exchange Rate

Worst GBP to USD exchange rate in December 2025: 1.3209

Best GBP to USD exchange rate in December 2025: 1.3513

Average GBP to USD exchange rate in December 2025: 1.3394

Port Operations

The maritime sector is currently experiencing a pre-holiday volume spike. Carriers are leveraging high demand to push through General Rate Increases (GRIs) before the seasonal lull in March.

Rerouting & Transit Times – The Cape of Good Hope remains the primary route. Transit times continue to be extended by 10–14 days.

Capacity & Equipment – Blank sailings are being used aggressively to maintain rate levels. With vessels on the Asia-Europe Lane currently at 90%+ utilization, “rolling” (cargo being bumped to the next vessel) is a high risk for bookings.

Spot rates have seen a 10–15% uptick since late December. We expect these to peak in the final two weeks of January as the “last ship out” scramble intensifies.

Airport Operations

Air freight remains the primary “safety valve” for UK importers facing ocean delays, though costs have slightly stabilized after the December 25th peak.

Pre-CNY Surge: While the absolute peak of the festive season has passed, rates remain 20–30% higher than the annual average. A second mini peak is expected in early February as shippers realise their sea freight won’t clear Chinese ports before the holiday.

Direct-to-consumer platforms continue to occupy significant belly-hold space. Traditional commercial cargo is seeing improved availability compared to December, but 48-hour terminal dwell times at Heathrow (LHR) remain common.

Expect a brief softening in rates mid-January before the final pre-CNY rush. Carriers are currently repositioning freighters to handle the anticipated surge in high-value electronics and Spring fashion.

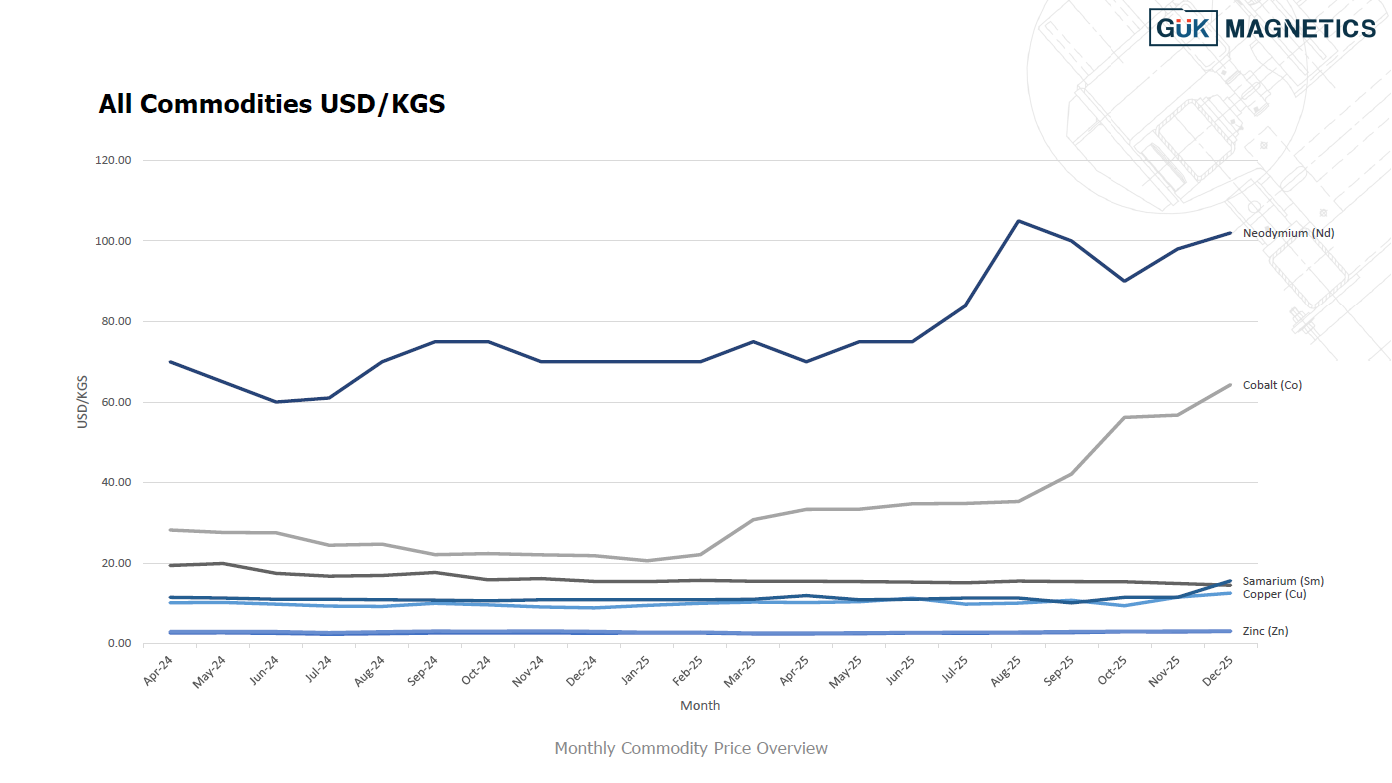

Commodity Rates

The most notable movements heading into January 2026 were seen in neodymium and cobalt. Neodymium increased month-on-month to $102.00/kg, recovering from the softer levels seen in October and reinforcing the firmer pricing trend observed through the second half of 2025. Cobalt continued its sharp upward movement, rising again in December to $64.31/kg, extending the strong increases seen in recent months.

At GUK Magnetics, we understand that today’s supply chain landscape demands flexibility and foresight. Our team is ready to help you plan shipments, manage risks, and ensure deliveries arrive with as little disruption as possible.

If you’d like to review current orders, discuss future requirements, or explore strategies to build resilience in 2026, please get in touch – we’re here to support your business at every stage. Contact us today.