Currency

The British Pound has held onto recent gains as the rapid spread of the Omicron variant continues to hinder the pace at which the global economy can recover from the Coronavirus pandemic. After the BoE (Bank of England) decided to raise rates in December, the Sterling ended the year in positive territory and remains resilient against its major counterparts.

Although fundamental factors continue to drive risk sentiment, a high vaccination rate in the UK combined with higher rates has supported GBP/USD despite a hawkish Federal Reserve (Fed).

As well as an increase in the GBP/EUR, we have also seen GBP/USD rally further. GBP/USD is now trading towards 1.36, which is the highest we have seen since October 2021.

The GBP/EUR rate hit the ground running in the opening week of 2022 and could attempt a foray above the nearby 1.20 handle over the coming days. Momentum could be difficult to sustain however for Sterling in light of a recently resilient performance from the Euro. Should levels rise upwards beyond the 1.20 mark, it would be the first time since the Coronavirus pandemic, making it a 23-month high for the pair.

Commodities

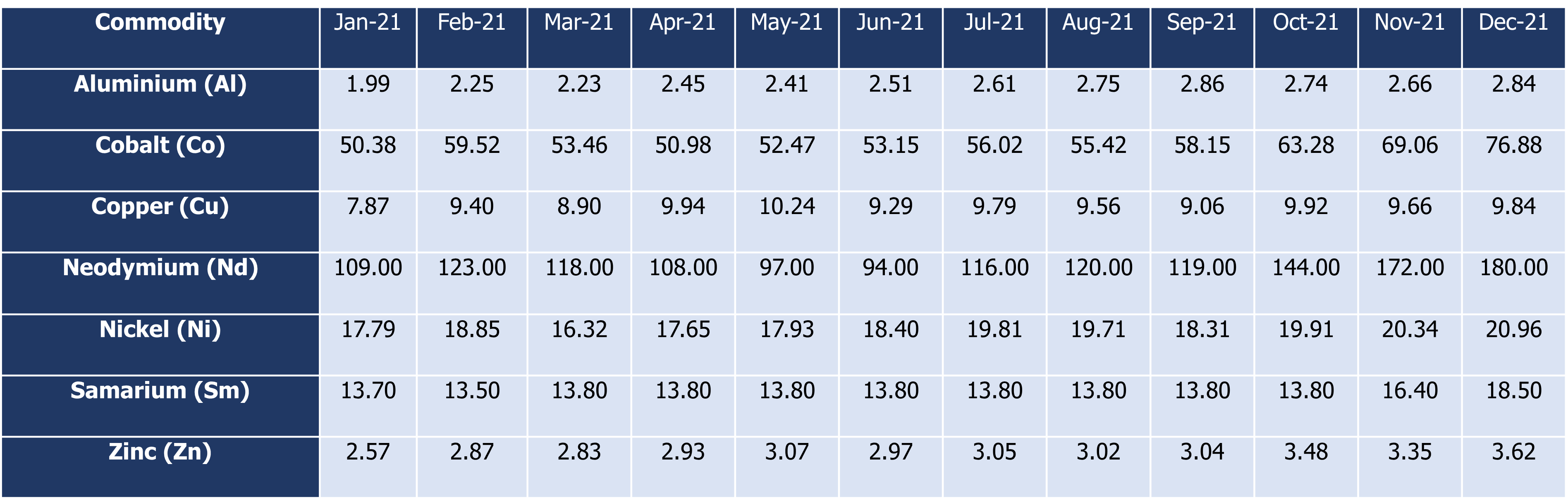

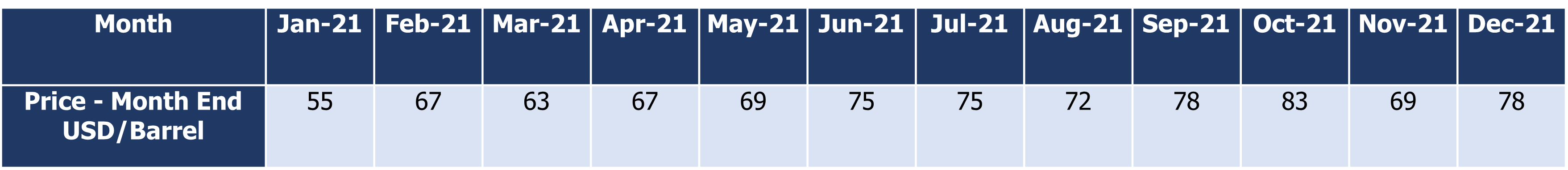

The end of 2021 saw all commodities increase, some significantly more than others. Neodymium again saw the biggest increase of 8 (USD/KGS), closely followed by Cobalt with a 7.82 (USD/KGS) increase. Samarium increased by 2.10 (USD/KGS), Nickel 0.62 (USD/KGS) and Zinc 0.27 (USD/KGS). Both Aluminium and Copper increased by 0.18 (USD/KGS) in December. The following tables show the fluctuations across the commodities throughout 2021.

Production and Freight

A rise in Covid cases in Ningbo resulted in an area wide government enforced lockdown from the 1st Jan 2022. This has now been lifted and normal business operations are resuming. Unfortunately, this lockdown has led to supply chain disruptions, which will be further exacerbated by the annual Chinese New Year holiday closures.

Ningbo port, the world’s third-largest container port, has reported operational issues as a result of the lockdown measures imposed upon them and the surrounding areas. Government roadblocks have inhibited the movement of truck drivers which has led to a backlog in the container terminals. To help with cargo flow, the port has established a whitelist system, to accelerate the approval of truck drivers and allowing movement, along with relocating some shortsea services to nearby harbours.

There has been no improvement on freight rates due to the volatile start to the year for ocean freight logistics and continuing demand for services. Rates will remain high until consumer demand starts to fall, with some predicting that this will not happen until Q4 2022.

Demand for air cargo and rates remain high as sea freight disruptions continue. However, services have been impacted by labour shortages because of the highly transmissible Omicron variant and mandatory quarantining period resulting in processing backlogs and service delays

Goudsmit UK

Goudsmit UK continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap and would urge you to review your requirements for 2022 – 2023 at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.