Currency

Pound to Dollar forecast for February 2022:

- Maximum 1.374

- Minimum 1.326

- Averaged exchange rate 1.350

The pound’s narrative has been scripted by two intertwined factors in recent months: entrenched inflation and interest rates.

- UK inflation is being pushed higher by a triumvirate of factors: higher energy costs, resurgent demand, and supply chain issues – pressures that are squeezing the cost of living.

- The BoE hiked interest rates in December and February to tame inflation. So, another dramatic surge in prices could prompt more aggressive policy tightening.

Investors will also monitor tensions between Russia and Ukraine after the US and UK governments called for their citizens to leave Ukraine as soon as possible amid the threat of an invasion. Sterling is pushing higher against the US dollar today as news begins to filter out that Russia is returning some of its troops back to base after conducting recent drills on the Ukrainian border. As ever, news flow can change in an instant so the latest move higher should be treated with some caution.

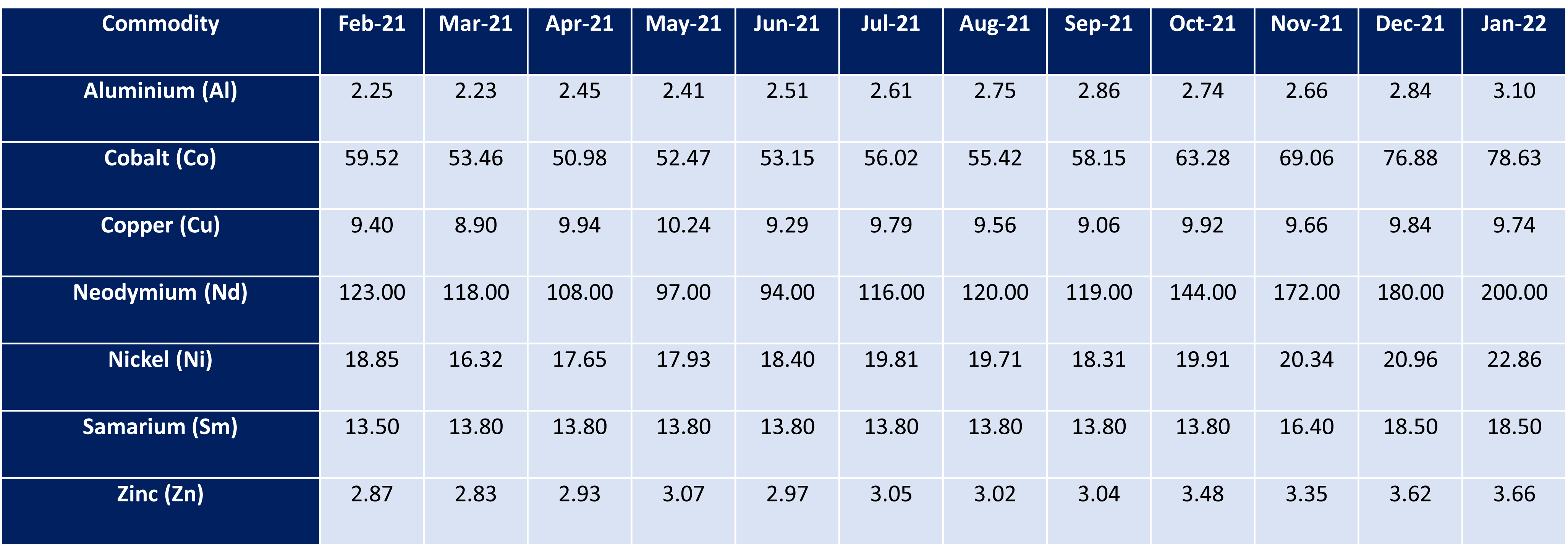

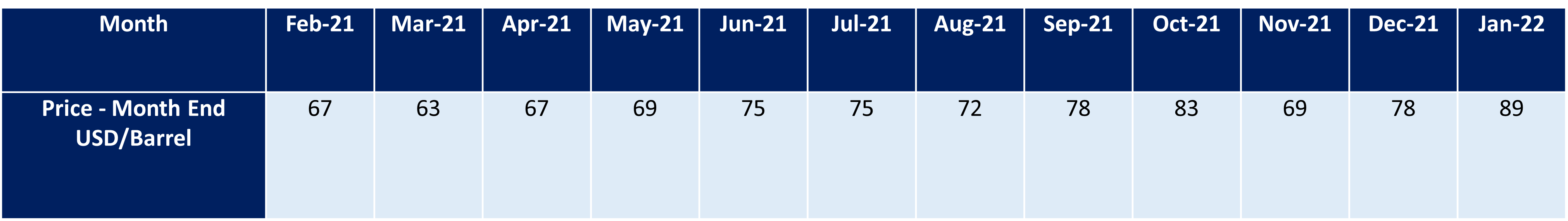

Commodities

The start of 2022 has brought with it the continuous increase across most commodities. Copper decreased by 0.10 (USD/KGS) while Samarium remained the same. The same can’t be said for Neodymium, which seen a further spike of 20 (USD/KGS). Nickel increased by 1.9 (USD/KGS), closely followed by Cobalt with a 1.75 (USD/KGS) increase. Aluminium increased by 0.26 (USD/KGS) and Zinc by 0.04 (USD/KGS).

Production & Freight Update

2022 looks set to be challenging for global cargo.

BIFA’s Director General Robert Keen believes that ongoing issues in ocean shipping, labour shortages due to Covid hitting port/airport operations, ongoing consumer spending for at least the first six to nine months despite inflation, elevated freight rates, rising e-commerce demand, semi-conductor demand/shortages and driver shortages are just some of the challenges facing supply chains this year.

As a result, freight rates will remain high until consumer demand starts to fall. Experts predict that this will not happen until after Q4 2022.

With regards to airfreight, unfortunately belly capacity has not returned to the pre-Covid levels that operators had hoped and is unlikely to recover to that extent this year.

In September 2021, it looked like the market was setting out on the road to normality, as major economies tentatively re-opened with easing Covid case numbers and the lifting of travel restrictions. Unfortunately, this was short lived, as November arrived bringing with it the Omicron variant. Travel restrictions tightened and lockdowns ensued resulting in supply chain issues and reductions in freighter capacity. With no certainty on potential future variants and ever-changing travel restrictions, it is likely that pressure will remain on the capacities and rates for the foreseeable.

The global cargo industry is hoping that the Omicron variant will see the end of the pandemic, but unfortunately there are still so many unknowns. Communication and flexibility will remain the key to managing the current market conditions.

Goudsmit UK

Goudsmit UK continue to communicate with all customers proactively. We manage expectations and providing multiple solutions, allowing customers to make conscious decisions when balancing cost versus supply chain risk.

We continue to advise all customers at the point of quotation and order confirmation of the extended lead times. Therefore, allowing any freight delays to be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d also urge you to review your requirements for 2022 – 2023 at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we’re working with our customers by holding larger volumes of UK stock for longer. We would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production. In order to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.