Currency Update

The GBP/USD pair seesaws between tepid gains/minor losses through the first half of the European session on 19th January and is currently trading around mid-1.2100s, nearly unchanged for the day. The Pound to Dollar exchange rate (GBP/USD) will look to the release of U.S. inflation data on 19th January to further underpin its multi-week rally, with a softer-than-expected reading potentially even allowing for fresh highs to be tested.

A bleak outlook for the UK economy has been fuelling speculations that the Bank of England (BoE) is nearing the end of the current rate-hiking cycle and undermines the British Pound. Apart from this, a softer risk tone extends some support to the safe-haven US Dollar and contributes to capping the upside for the GBP/USD pair.

The British Pound is trying to move higher in itself last week. However, the economic backdrop remains neutral to negative as the UK government struggles to control a raft of strikes currently hitting the country. The UK now needs to solve the current wave of industrial action. Otherwise the current small bid in Sterling will quickly evaporate.

U.S. data is firmly in the driving seat, not just of GBP/USD, but all Pound exchange rates, owing to the UK currency’s ongoing positive correlation with global investor sentiment.

Production Update

China continues to grapple with rising Covid infections. Approximately 64% of the country’s population are currently infected. The peak wave is expected to continue for another 2 to 3 months. Cases in rural China are expected to surge over the New Year celebrations when much of the population return to hometowns for the holiday.

Chinese manufacturing contracted in December, as it felt the impact of the abrupt abandonment of the country’s strict zero-Covid regime. However, there is increased confidence in the market for the year ahead. It’s hoped that the country will be past its worst by February and will start to rebound.

Freight Update

The volume of Covid infections is also taking its toll on Chinese ports. Container dwell times are on the up as infections increase. These are expected to continue to rise with the Chinese New Year seasonal delays. This combined with existing port congestion and skipped vessels, increases the pressure on already crippled ports and shipping lines.

Seatrade Maritime News reported that on the Asia – North Europe trade, blanked sailings have increased 715% against 2019 figures.

On a positive note, after more than 2 years of exceptionally high freight rates, shippers are starting to see some relief.

As availability for freight capacity globally opens up, and reductions in freight volumes due to the weakening global economy, shipping analysts have announced that they are expecting rates to fall further in 2023.

Eli Glickman, the president and CEO of shipping line ZIM, when asked about elevated freight rates, stated that ‘while we anticipate some decline in rates for the remainder of the year, we expect the normalisation to be gradual’.

The usual pre-holiday rise in air cargo demand has not been realised this year. Economic pressures continue to put the brakes on consumer spending. This has been confirmed by the continuing downward trend in rates.

The Chinese economy is growing much slower than it has in decades. This is a result of power rationing and ongoing quarantine restrictions limiting factory output. High inventories, inflation and consumer shifting to spend more on services has curtailed the demand for sea and air freight. European production has slowed due to energy challenges associated with the ware in Ukraine. More companies are reverting to ocean cargo as the freight conditions continue to improve in cost and service.

Brexit

The UK and EU appear to be nearing an agreement on customs. It’s hoped that this will reduce the friction between GB and NI. This could also pave the way to further wider post-Brexit negotiations. Officials are hoping to announce significant progress towards a solution in the coming days. However, this sentiment is not held by all parties, who believe there are large gaps remaining on many issues.

The has proposed ‘green’ and ‘red; customs lanes for goods, allowing those destined only for NI to be separated from those heading for the EU. It’s proposed that this, along with a ‘trusted trader’ program, would ease the amount of paperwork required for customs completion and simplify the process.

Commodity Update

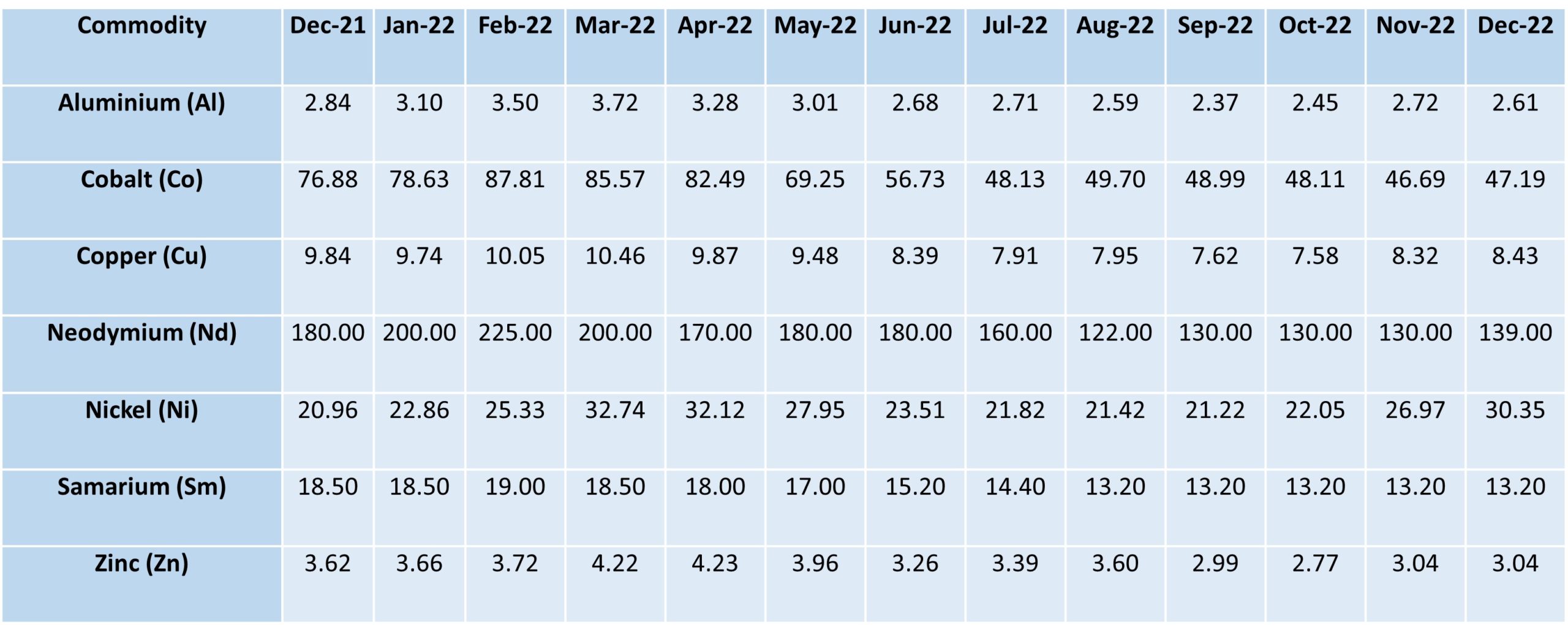

December saw majority of commodities begin to rise again. Aside from Zinc which remained at 3.04USD/KGS and Samarium which remained at 13.20USD/KGS for the 5th month in a row. Aluminium was the only commodity tracked which decreased in December, with a 0.11USD/KGS reduction. Neodymium jumped by 9USD/KGS, Nickel by 3.38USD/KGS, Cobalt by 0.50USD/KGS and Copper by 0.50USD/KGS.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.