Interest Rates

Source – Bloomberg UK

Bank of England policy maker Catherine Mann has urged her fellow rate-setters to “stay the course” to carry on raising interest rates even though markets are betting on the approaching end of the most aggressive hiking cycle in three decades.

Mann said the UK central bank is most likely to increase borrowing costs again at its next meeting rather than pause but warned of the risk of letting up in the fight against inflation too early.

“The consequences of under tightening far outweigh, in my opinion, the alternative,” Mann said in the text of a speech given in Budapest on Monday. “We need to stay the course. In my view the next step in bank rate is still more likely to be another hike than a cut or hold.”

Mann is one of the most hawkish members of the BOE’s nine-member Monetary Policy Committee. This month he voted with the majority for a half-point hike in the key rate. This is now at 4%, the highest since 2008. Previously, she sought quicker hikes.

Last week the BOE signalled that it is approaching the end of its tightening cycle to tackle double-digit inflation. Markets have only fully priced in one further quarter-point increase to bank rate before cuts are considered by the end of the year.

However, Mann said there are few signs of a turning point for UK inflation. He further warned of “material upside risks” to the outlook on prices. Gilts extended a fall after Mann’s comments, with the yield on two-year bonds rising 12 basis points to 3.37%.

Exchange Rates – GBP/USD

Average Exchange Rate – Jan 2023 GBP1 / USD 1.223652

The Pound began the week on narrow footing, with the International Monetary Fund (IMF) warning that the UK economy would be the only one to shrink in 2023.

Further pressure was then added by the largest coordinated strike action in UK history, with over 500,000 workers walking out over the continued pay disputes.

However, the Federal Reserve’s interest rate decision saw the Pound buoyant as the market mood turned upbeat.

These gains were then gradually erased over the course of the end of the week, following the Bank of England’s (BoE) interest rate decision. While the 50bps hike was expected, the language employed by BoE Governor Andrew Bailey indicated that the next rate hike would be smaller, leaving Sterling to fall to the lowest levels seen since mid-January.

Production Update

The Covid situation in China has considerably improved. Despite a busy festival season that included the Chinese New Year travel rush. Cases in the country have not witnessed the major uptick that was expected. China’s Centre for Disease Control and Prevention (CDC) suggested the number of infections peaked in mid-December last year and have since plateaued.

Chinese manufacturing continues to contract as the global demand outlook shows little sign of any short-term improvement. The developed nations are still facing inflationary and recessionary pressures. However, the increased confidence in the market for the year ahead remains, with predictions of a surge in demand and trade from the second half of 2023.

Freight Update

Ports in China are operating without any major issues at present. Ningbo port is not experiencing any equipment issues & no weather disruptions. However, space on the dockside is tight due to a high volume of empty containers. Freight rates have remained fairly static over the last month.

Airfreight prices are continuing to fall as a result to the bleak market outlook. Airport operations are normal with good capacity.

The Chinese economy is growing much slower than it has in decades, as power rationing and ongoing quarantine restrictions continue to limit factory output. High inventories, inflation and consumer shifting to spend more on services has curtailed the demand for sea and air freight. European production has slowed due to energy challenges associated with the ware in Ukraine. More companies are reverting to ocean cargo as the freight conditions continue to improve in cost and service.

Brexit

The United Kingdom’s Supreme Court has dismissed a challenge to the lawfulness of the NI Protocol. This governs post-Brexit trade between the British province and mainland Britain. The legal challenge, which was brought by pro-Brexit activists and former leaders of NI’s largest unionist parties, argued that the protocol undermined its place in the United Kingdom.

Meanwhile, the UK and EU continue to make progress on the NI Protocol. They appear to be nearing an agreement on customs, with the intention of reducing the friction between GB and NI. This could also pave the way to further wider post-Brexit negotiations. Officials are hoping to announce significant progress towards a solution in the coming days. However, this sentiment is not held by all parties, who believe there are large gaps remaining on many issues.

The has proposed ‘green’ and ‘red; customs lanes for goods, allowing those destined only for NI to be separated from those heading for the EU. It’s proposed that this, along with a ‘trusted trader’ program, would ease the amount of paperwork required for customs completion and simplify the process.

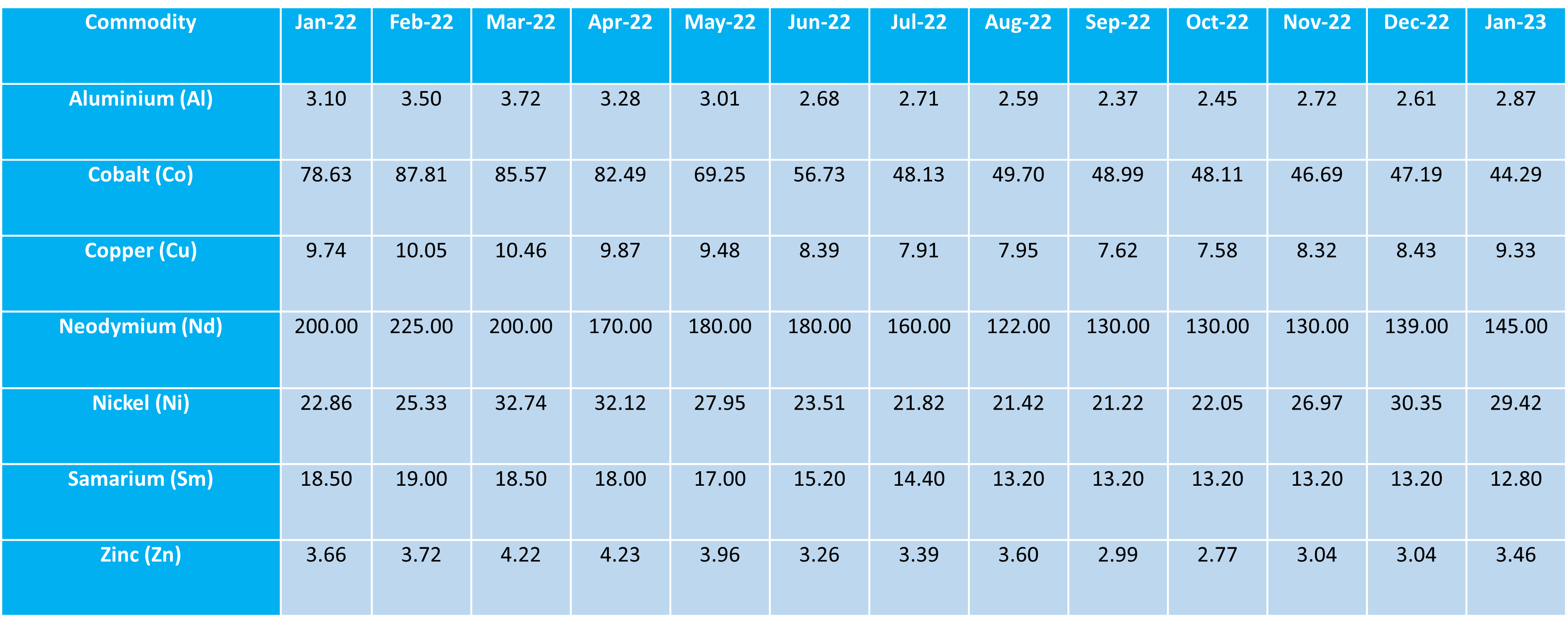

Commodity Update

January saw a shift across all commodities tracked. Neodymium jumped by another 6 USD/KGS, Copper by 0.9 USD/KGS, Zinc by 0.42 USD/KGS and Aluminium by 0.26 USD/KGS. Other commodities saw a reduction in January, Cobalt reduced by 2.9 USD/KGS, Nickel by 0.93 USD/KGS and Samarium by 0.4 USD/KGS.

Goudsmit UK’s Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer. We would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production. This helps reduce the impact of freight delays and lessen the potential requirement for costly airfreight.