Currency

The British Chambers of Commerce’s outlook for the UK economy sees Britain avoiding a recession this year, but also expects growth to remain below pre-pandemic levels until late 2024, Bloomberg’s Philip Aldrick reports.

While the lobby group sharply upgraded its forecasts — having previously seen a 1.3% contraction this year — it’s also urging the government to encourage businesses to invest or risk the UK being “left behind by our competitors.”

As Alex Veitch, the BCC’s director of policy, noted:

“Although the economy should now avoid a technical recession, the stark reality is that businesses face a very difficult year ahead. Businesses tell us they are most concerned about the difficulties in recruiting staff, paying their energy bills and rising taxes.”

The pound is edging higher as UK trading gets underway, though it has yet to recover to its levels above $1.20 at the start of the week. Futures point to a lower open for the FTSE 100, following declines in major equity indices in Asia.

Apart from this, speculations that the Bank of England (BoE) would pause the current tightening cycle suggest that the path of least resistance for the GBP/USD pair is to the downside. Hence, any subsequent move up might still be seen as a selling opportunity. Traders now look to the US macro data – Challenger Job Cuts and the usual Weekly Initial Jobless Claims – for a fresh impetus and short-term opportunities.

Sources – Bloomberg, FX Street, Daily FX

GBP/USD

| Overview | |

| Today Last Price | 1.1853 |

| Today Daily Change | 0.0004 |

| Today Daily Change % | 0.03 |

| Today Daily Open | 1.1849 |

| Trends | |

| Daily SMA20 | 1.2025 |

| Daily SMA50 | 1.2133 |

| Daily SMA100 | 1.2003 |

| Daily SMA200 | 1.1906 |

| Levels | |

| Previous Daily High | 1.186 |

| Previous Daily Low | 1.1803 |

| Previous Weekly High | 1.2143 |

| Previous Weekly Low | 1.1922 |

| Previous Monthly High | 1.2402 |

| Previous Monthly Low | 1.1915 |

Sources – Bloomberg, FX Street, Daily FX

Production Update

The Covid situation in China continues to improve. Chinese manufacturing continues to contract as the global demand outlook shows little sign of any short-term improvement. The developed nations are still facing inflationary and recessionary pressures. However, the increased confidence in the market for the year ahead remains, with predictions of a surge in demand and trade from the second half of 2023.

Ports in China are operating without any major issues at present. Ningbo port is not experiencing any equipment issues & no weather disruptions. However, space on the dockside is tight due to a high volume of empty containers.

Freight Update

Record capacity increases and improving supply chain logjams have driven down shipping rates across trucking, maritime and air cargo. Xenata, a freight rate and market analyst, reports that global ocean freight rates have experienced their biggest ever decline, dropping by 13.3% month-on-month. This marks the fifth straight month of declining prices. Xenata further predicts that there is little indication of a shift in the near future. Therefore, carriers will be facing a challenging year ahead.

However, procurement teams should be cautious of the “double-edged” consequences of declining freight rates. Simon Heaney, senior manager of container research at Drewry Logistics consultancy has noted that during the pandemic, heavy congestion throughout the supply chain and an enormous surge in demand led to a dramatic increase in freight rates. However, the reverse is now taking place as the economy cools rapidly. In response, shippers will seek to limit capacity in order to maintain prices.

Air Freight

Similarly, global air cargo demand also saw a decrease, with an 8% month-on-month drop in February. The Chinese economy is growing much slower than it has in decades, as power rationing and ongoing quarantine restrictions continue to limit factory output. High inventories, inflation and consumer shifting to spend more on services has curtailed the demand for sea and air freight. European production has slowed due to energy challenges associated with the ware in Ukraine, and more companies are reverting to ocean cargo as the freight conditions continue to improve in cost and service.

However, air freight prices rose sharply this week as exports of e-commerce goods increased significantly this week. All eyes will be watching to see if this demand will be sustained.

Airport operations are normal with good capacity and no weather disruptions or flight cancellations.

Brexit

The UK and EU made significant progress on the NI Protocol in February with the establishment of the Windsor Framework. The agreement aims to address some of the challenges and uncertainties that have arisen since the Protocol came into effect. This includes issues around trade, security, and governance.

Under the Windsor Framework, the UK and the EU have committed to working together to ensure that the Protocol is implemented effectively and that the unique circumstances of Northern Ireland are taken into account. The agreement includes provisions for regular dialogue and cooperation between the UK and the EU on issues related to Northern Ireland. Alongside a commitment to respecting the principle of consent that underpins the Good Friday Agreement.

Brexit – Red & Green Lanes

The agreement revolves around the idea of dividing goods into green and red lanes.

Where British goods are to remain in Northern Ireland, they will be directed through the green lane at NI ports. This will involve minimal documentation and no regular physical inspection.

On the other hand, goods intended for transportation into Ireland will use the red lane and will be subject to customs processes and other checks at NI ports.

To utilise the green lane, companies must enrol as a trusted trader under the newly established UK Internal Market Scheme (UKIMS). Supermarkets and other firms that are members of the existing Trusted Trade Scheme will be automatically transferred to UKIMS.

Overall, the Windsor Framework represents a significant step towards resolving some of the outstanding issues related to Brexit and the Northern Ireland Protocol, and it provides a foundation for continued cooperation and stability between the UK and the EU.

The Prime Minister confirmed on that MPs will be offered a formal vote on the new deal in the coming weeks. Although MPs will be given time ‘to digest’ the complex framework.

The Democratic Unionist Party (DUP), who are currently boycotting the election of a power sharing executive in Northern Ireland, have advised that they won’t be rushed into a making a decision on whether to back the U.K.’s new agreement, stating that it will be April at the earliest and adding that they will not let the approaching anniversary of the Good Friday Agreement (10th April) influence the timing of their verdict.

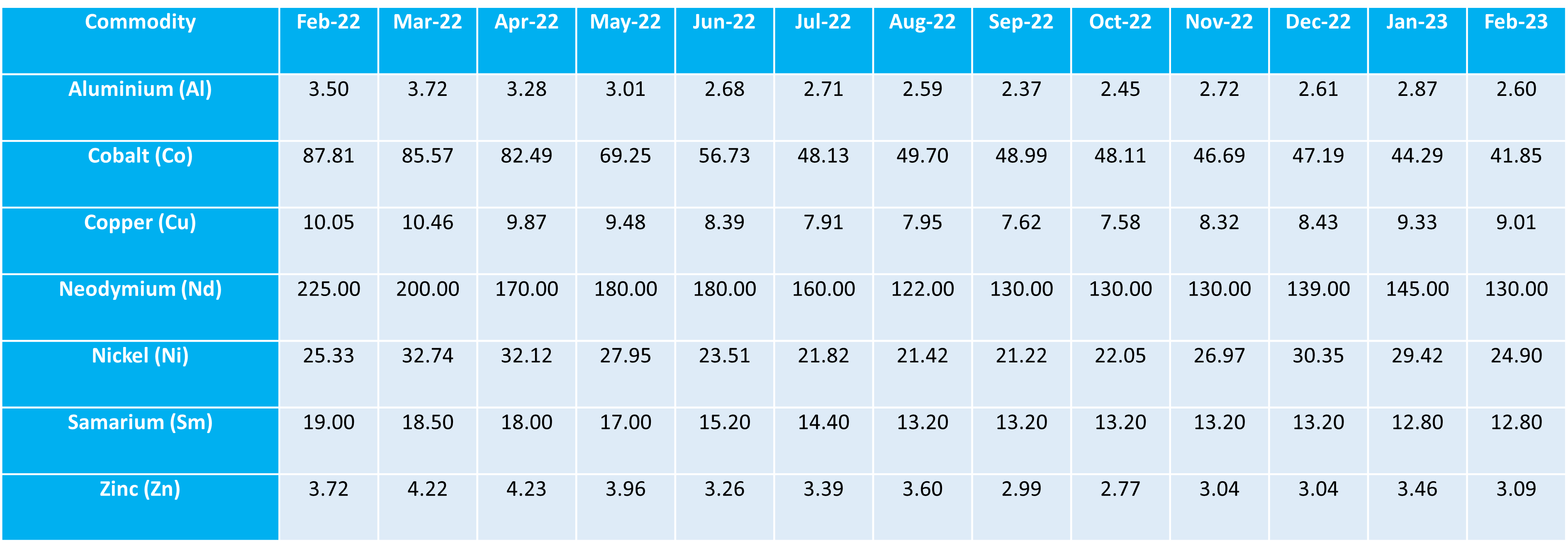

Commodity Figures

Last month, a number of key industrial metals experienced significant declines in price. This included Aluminum(-0.27USD/KGS), Cobalt(-2.44USD/KGS), Copper(0.32USD/KGS), Neodymium(-15USD/KGS), Nickel(-4.52USD/KGS), and Zinc(-0.37USD/KGS). These metals are critical inputs for a wide range of industries, including manufacturing, construction, and electronics. Therefore, their prices are closely watched by investors and analysts as an indicator of broader economic trends. The decline in prices for industrial metals highlights the complex and interconnected nature of global markets and serves as a reminder of the challenges facing the global economy.

Moreover, Samarium, a rare earth element with a wide range of industrial applications, has remained relatively stable in price for the past two months. The stability in samarium prices can be attributed to a number of factors. Including consistent demand from industries such as electronics, renewable energy, and automotive manufacturing. The stability in samarium prices is good news for businesses that rely on the element as an input, as it provides a degree of predictability and stability in their supply chains. While the future of commodity prices remains uncertain, the stability of samarium prices may serve as a bright spot in an otherwise turbulent market.

As always, the metals markets remain unpredictable and subject to a range of factors. Moreover, it will be interesting to see how they evolve in the coming months.

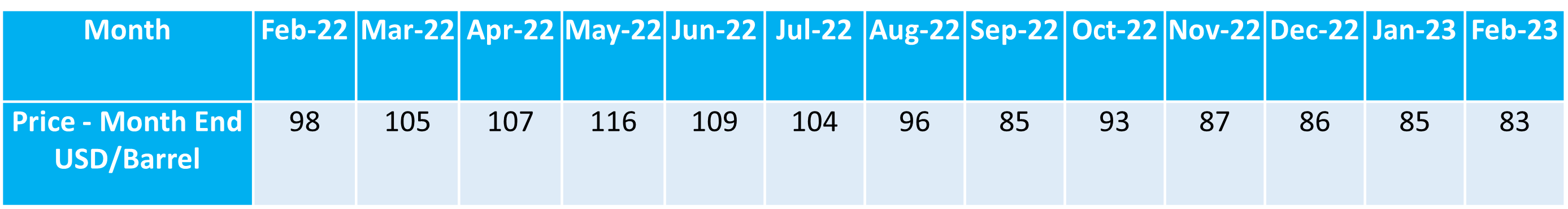

In February, the global oil market saw a slight drop in the price per barrel of Brent crude oil. Brent crude, which is a benchmark for global oil prices, fell by around 2 USD/Barrel over the course of the month. The oil market continues to be impacted by production cuts from major oil-producing countries, such as Saudi Arabia and Russia, as they sought to stabilise prices and balance the market.

Despite the small drop in February, the price of Brent crude oil has remained relatively stable over the last few months. This has been a welcome relief, as prices had increased sharply in 2022.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.