Currency

Following a consolidation phase in the Asian session on Tuesday, GBP/USD has gathered bullish momentum and advanced to its highest level since June 2022 above 1.2500. The pair’s near-term technical outlook suggests that there could be a technical correction before the pair continues to push higher.

The broad-based selling pressure surrounding the US Dollar (USD) since the beginning of the American session on Monday fuels GBP/USD’s rally this week. Despite renewed concerns over rising crude oil prices negatively impacting the global economic activity and the inflation outlook, risk flows dominated markets on Monday, not allowing the USD to find demand.

Early Tuesday, the USD stays on the back foot as the market mood remains relatively upbeat with US stock index futures trading modestly higher on the day.

Meanwhile, Bank of England (BOE) policymaker Silvana Tenreyro, who voted to keep the policy rate unchanged at 4% at the last policy meeting, argued on Tuesday that a looser policy stance is needed to meet the inflation target.

“In the absence of further counterbalancing cost-push shocks, I judge inflation is likely to fall well below target,” Tenreyro said and noted that the BOE policy is already in restrictive territory. These comments, however, don’t seem to be having a noticeable impact on Pound Sterling’s performance for the time being.

Later in the day, February Factory Orders and JOLTS Job Openings data from the US will be looked upon for fresh impetus. Nevertheless, the USD is likely to have a difficult time outperforming its rivals unless there is a move toward safe-haven assets in markets.

Sources – Daily FX & Pound Sterling Live

Production Update

The COVID situation in China continues to improve. Chinese manufacturing continues to contract as the global demand outlook shows little sign of any short-term improvement. The developed nations are still facing inflationary and recessionary pressures. However, the increased confidence in the market for the year ahead remains. There are predictions of a surge in demand and trade from the second half of 2023.

Freight Update

Ports in China are operating without any major issues at present. Ningbo port is not experiencing any equipment or capacity issues & there are no weather disruptions.

According to the most recent ocean freight rates data provided by Xenata, there appears to be a growing trend of ‘normalisation’ in the reefer market. Spot rates from the Far East to Northern Europe are well on track to return to their pre-pandemic levels.

Airport operations are relatively stable, with good capacity and no weather disruptions or flight cancellations.

Recent reports suggest a slight improvement in the air cargo market due to increased production in China. London’s Air Cargo News mentioned that the market had been experiencing falling spot prices. They’ve also been experiencing contract renegotiations at lower levels for an extended period. However, sources now indicate that the market may be close to reaching its bottom.

While airfreight yields and total revenues continue to be high compared to historical standards, global tonnages have decreased to levels like those seen in 2015/16. According to reports from freight forwarding and shippers, this decline may be partially attributed to inventory level adjustments after the restocking that occurred in early 2022 in response to congestion and expected congestion in ocean freight supply chains, as well as weaker and less predictable consumer demand in some sectors. Several sources suggest that the current subdued demand may persist throughout the first half of 2023. Moreover, demand levels could improve in the second half of the year as inventory levels decrease.

Brexit

The UK and EU made significant progress on the NI Protocol in February with the establishment of the Windsor Framework. The agreement aims to address some of the challenges and uncertainties that have arisen since the Protocol came into effect. This includes issues around trade, security, and governance.

Under the Windsor Framework, the UK and the EU have committed to working together to ensure that the Protocol is implemented effectively and that the unique circumstances of Northern Ireland are taken into account. The agreement includes provisions for regular dialogue and cooperation between the UK and the EU on issues related to NI. Alongside a commitment to respecting the principle of consent that underpins the Good Friday Agreement.

Green & Red Lines

The agreement revolves around the idea of dividing goods into green and red lanes.

Where British goods are to remain in Northern Ireland, they will be directed through the green lane at NI ports. This will involve minimal documentation and no regular physical inspection.

On the other hand, goods intended for transportation into Ireland will use the red lane. These goods will be subject to customs processes and other checks at NI ports.

To utilise the green lane, companies must enroll as a trusted trader under the newly established UK Internal Market Scheme (UKIMS). Supermarkets and other firms that are members of the existing Trusted Trade Scheme will be automatically transferred to UKIMS.

Overall, the Windsor Framework represents a significant step towards resolving some of the outstanding issues related to Brexit and the NI Protocol. It also provides a foundation for continued cooperation and stability between the UK and the EU.

A Vote Ahead Amidst DUP’s Cautious Stance

The Prime Minister confirmed that MPs will be offered a formal vote on the new deal in the coming weeks. Though MPs will be given time ‘to digest’ the complex framework.

The Democratic Unionist Party (DUP), who are currently boycotting the election of a power sharing executive in Northern Ireland, have advised that they won’t be rushed into a making a decision on whether to back the U.K.’s new agreement. They noted that it will be April at the earliest and that they’ll not let the approaching anniversary of the Good Friday Agreement (10th April) influence the timing of their verdict.

The UK has confirmed that it will reduce the post-Brexit checks on goods arriving from the EU. A new model has been introduced to ‘minimise the burden on traders and ensure border security while staying aligned with international standards.’

The government has postponed implementing these checks four times. This is despite them being a legal requirement under the Brexit trade agreement with the EU. However, the specifics of the new customs and regulatory process have now been established. They will be launched later this year.

The plan is still in the draft stage, and the government has requested feedback from businesses before making it official.

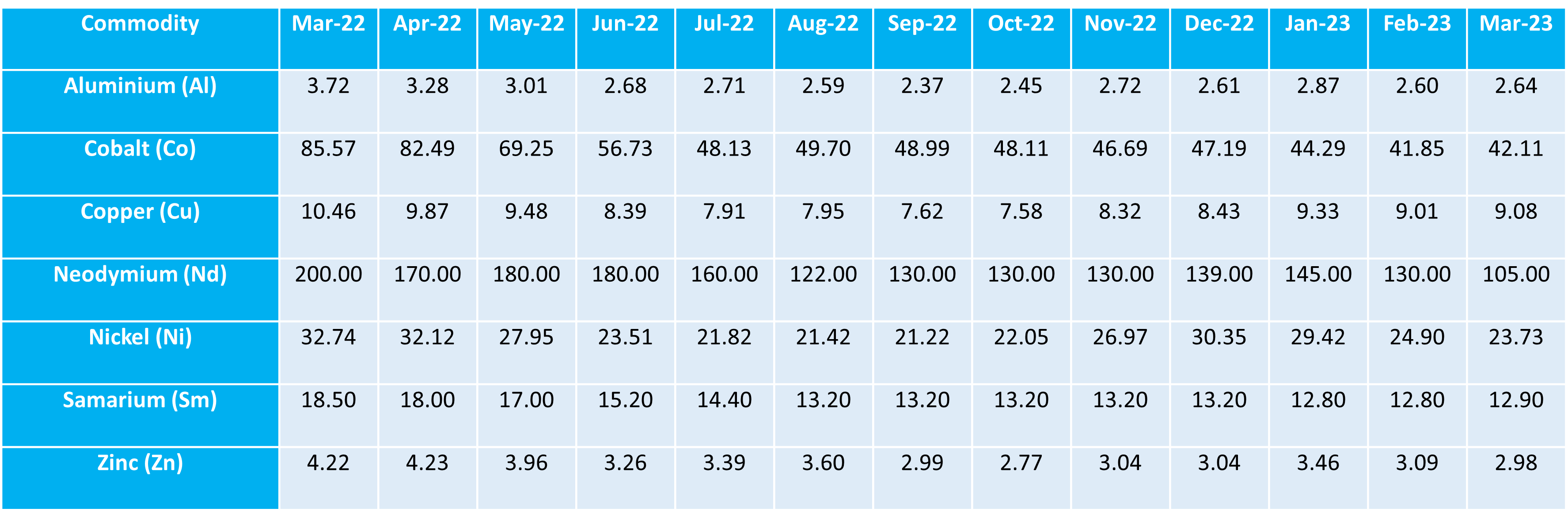

Commodity Figures

Neodymium (-25 USD/KGS), Nickel (-1.17 USD/KGS), and Zinc (-011 USD/KGS) all experienced a decrease in price in March due to a combination of factors. This includes changes in supply and demand, as well as broader economic and geopolitical concerns.

The commodity Neodymium experienced a significant decrease in price of around 25 USD/KGS in March. This was due to a combination of factors that led to a surplus of supply in the global market. This decline in demand was partly due to disruptions in global supply chains caused by the COVID-19 pandemic. Which led to a slowdown in the production of electric vehicles and renewable energy equipment.

Aluminum (0.04 USD/KGS), Cobalt (0.26 USD/KGS), Copper (0.07 USD/KGS), and Samarium (0.10 USD/KGS) experienced small increases in price in March. This was due to a combination of factors that impacted supply and demand for these commodities.

As always, the metals markets remain unpredictable and subject to a range of factors.

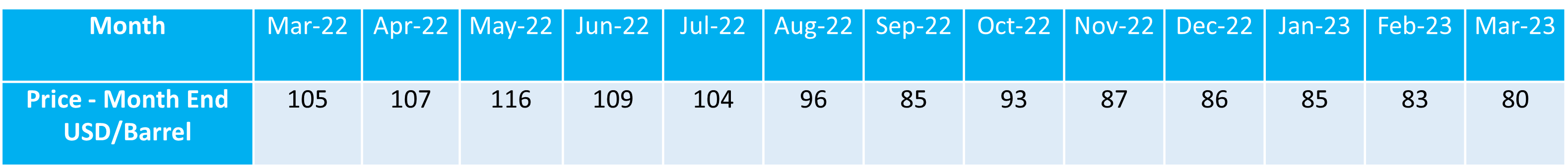

In March, the price of Brent crude oil decreased by a further 3 USD per barrel. This was due to a number of factors that impacted supply and demand for the commodity.

We will continue to monitor the situation and keep you updated on any further developments.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times. This will them to be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we’re working with our customers by holding larger volumes of UK stock for longer. We’d also encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production. This will help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.