Currency

GBP/USD is hovering around 1.2700, languishing near three-week lows in early Europe on “Super Thursday”. The pair is undermined by a broad US Dollar strength and the market’s anxiety ahead of multiple US data and the Bank of England (BoE) monetary policy announcements.

The BoE updates will be important for the GBP/USD trades to watch ahead of the multiple US data surrounding employment and activity. Among them, US ISM Services PMI, Factory Orders, Weekly Initial Jobless Claims and quarterly readings of Nonfarm Productivity and Unit Labour Costs gain major attention. Automatic Data Processing (ADP) will release the private sector employment data for July. A weaker-than-expected print could highlight looser conditions in the labour market and hurt the USD with the immediate reaction. Nevertheless, GBP/USD is likely to stay on the back foot unless risk flows return to markets.

GBP/USD dropped to its lowest level since July 7 at 1.2740 on Tuesday. However, it managed to stage a rebound in the early Asian session on Wednesday. The pair, however, failed to stabilise above 1.2800 and was last seen trading in a narrow range below that level.

The risk-averse market atmosphere doesn’t allow Pound Sterling to find demand. The UK’s FTSE 100 Index is down more than 1.5% and US stock index futures are losing between 0.75% and 1.3% in the European session.

Source – FX Street.com

Production & Freight Update

China, like many other regions worldwide, has been grappling with a string of extreme weather events this summer. Unprecedented heatwaves struck the nation earlier than expected, while global records tumbled for soaring temperatures, oceanic heat, and the alarming loss of sea ice. Last week, Typhoon Doksuri made landfall in the southeastern coastal province of Fujian, progressively losing intensity as it advanced northward. However, the storm left a trail of havoc, inundating at least five northern Chinese provinces with copious amounts of rainfall since Saturday. More than 31,000 people were evacuated from the Chinese capital by Sunday night, according to state broadcaster CCTV.

Meanwhile, state news agency Xinhua reported that an additional half a million residents in Fujian were compelled to evacuate due to widespread flooding. To exacerbate the situation, meteorologists issued warnings of an impending hurricane-level storm. Incoming Typhoon Khanun, the sixth typhoon projected to hit China this year. Forecasters expect storm tides to hit coastal areas of eastern Zhejiang province this week as Typhoon Khanun draws closer.

Currently, most ports in China are operating without any significant issues. However, Typhoon Doksuri may impact operations in some ports this week. The current waiting time at Ningbo port is approximately 2-4 days.

Developed nations continue to face the challenges of inflation and recession, with central banks responding by raising interest rates further. Therefore, causing financial conditions to become more restrictive.

Chinese manufacturing is experiencing a contraction as global demand shows little sign of short-term improvement. The robust Chinese economy previously supported ocean shipping, with the production of goods filling container ships and car carriers during their outbound journey and generating demand for bulk commodities that fill bulkers and tankers during their inbound voyage.

However, with Western demand for Chinese containerised exports declining, the anticipated post-COVID recovery in Chinese domestic spending is also weakening. Despite expectations of Chinese stimulus measures, there is growing scepticism about their effectiveness in significantly revitalising bulk commodity shipping rates. Especially if not focused on raw materials and facing persistently low demand and insufficient cancellations of sailings by carriers.

Data from Container xChange highlights the substantial drop in prices of 20-foot containers globally over the last few years. For instance, at Ningbo port, rates have fallen from $2298 in June 2021 to $1289 in June 2023.

Looking ahead, it is unlikely that freight rates will return to pre-pandemic levels. This is primarily due to increased costs leading to an upward adjustment of minimum pricing. The ongoing evaluation of freight rates in both pandemic and pre-pandemic contexts suggests that a full return to previous levels may remain elusive.

The container shipping market has been accustomed to cyclical patterns over the years, witnessing an extraordinary peak in 2021 and 2022. During this period, liners enjoyed record rates and profits.

However, the current scenario is changing as consumers begin to cut back on their spending on higher-priced goods. This comes at a time when the global economy is grappling with an inflation shock and rapid interest rate hikes. In turn, leading to a significant slowdown in demand. As a result, spot rates on major trade routes have rapidly declined.

Looking ahead, the container shipping industry is expected to face a new challenge in the form of a wave of investment in new vessels. This influx of new capacity is likely to be more noticeable in the coming years, impacting market dynamics.

The air cargo market is anticipated to witness minimal changes in the upcoming months, as prevailing conditions point to soft demand, capacity expansions, and continued downward pressure on rates.

In the second quarter, DHL Group experienced a decline in airfreight volumes, which the company attributed to a “less dynamic market environment”. The volumes dropped by 13% year on year. Alongside this decrease in volumes, the company’s revenue also took a significant hit, plummeting by 46.8%.

However, SGL expressed its belief that supply would exceed demand in the foreseeable future. The company noted a slight decrease in capacity supply after the summer holiday period, mainly due to reduced passenger flights. However, this decrease is not expected to significantly impact the overall supply and demand dynamics. SGL’s statement emphasised that a potential upturn in demand hinges on favourable changes in the macro and geo-political environment.

Moreover, the decreasing inflation levels were anticipated to have a positive influence. Some analysts also speculated that the drastic reduction in inventory levels might have been excessive. Therefore, potentially leading to a surge in airfreight demand. Overall, the situation remains uncertain, awaiting further developments.

According to the Civil Aviation Administration of China, daily flights in the country experienced a strong rebound, reaching 89% of the 2019 level during the first half of this year.

Airport operations in Northern China are currently experiencing stability with no flight cancellations. Southern China is experiencing some flight cancellations due to the impact of Typhoon Doksuri.

Brexit

Since the United Kingdom’s departure from the EU’s Single Market and Customs Union, over two and a half years have passed. Thus, revealing increasingly apparent negative consequences of Brexit on UK trade and the labour market. In terms of trade, once pandemic-related effects are accounted for, there is clear evidence of a significant reduction in EU-UK trade in both directions. However, there is a possibility of partial recovery over time as UK and EU businesses fully adapt to the new environment.

The share of trade in relation to GDP has also declined, and numerous small and medium-sized UK companies have withdrawn from engaging in trade with the EU. On the labour market front, the cessation of free movement for EU citizens has contributed to a recent upsurge in labour shortages. Particularly in sectors employing lower-skilled workers. Nonetheless, other factors beyond Brexit may have played a more substantial role in the decline of UK labour force participation. The long-term impacts remain uncertain, including how the slowdown in EU trade and migration might affect potential labour supply and future productivity.

Northern Ireland

Northern Ireland continues to lack a functioning government as the DUP withdrew its participation in protest the post-Brexit trading arrangements for the region. While the UK and EU reached the Windsor Framework to streamline procedures for goods entering Northern Ireland from Britain earlier in the year, the DUP is seeking further assurances.

However, the DUP has faced significant criticism. Many now believe that with the new Windsor Framework, Northern Ireland is in a highly advantageous position.

Despite the absence of local ministers, the responsibility of setting Northern Ireland’s budget for 2023/24 has fallen on the current Secretary of State for Northern Ireland, Chris Heaton-Harris. In addition, senior civil servants have taken on the task of managing departments in the region.

However, the financial situation is deteriorating. Many civil servants express the need for substantial additional funding, amounting to hundreds of millions of pounds. This is to sustain public services at their present level.

Commodity Rates

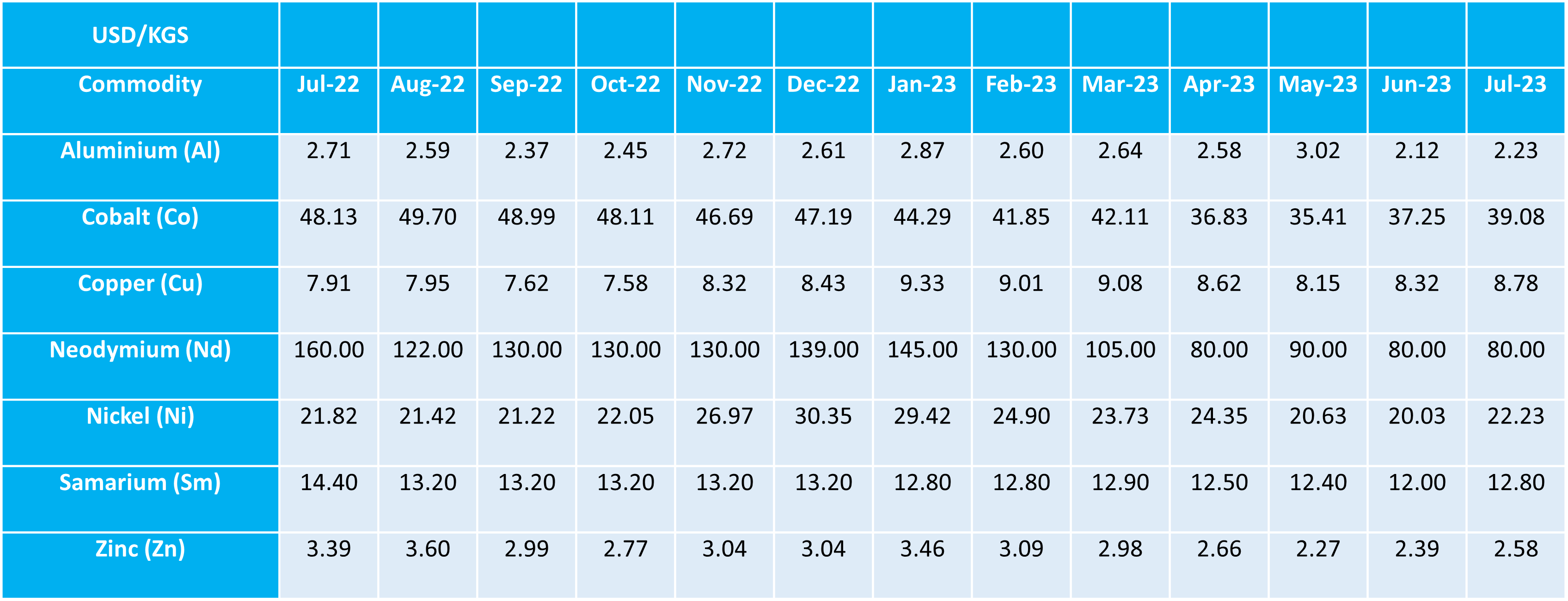

In July, tracked commodity rates displayed a general trend of increase. All commodities witnessed a surge in their prices, except for Neodymium, which remained stable at 80 USD/KGS. Notably, Aluminium recorded a modest rise of 0.11 USD/KGS. Cobalt, a vital component in electric vehicle batteries, experienced a substantial increase of 1.83 USD/KGS. Copper, an essential metal utilised in various industries, saw a notable rise of 0.46 USD/KGS. Nickel also showed an upward movement of 0.2 USD/KGS, driven by its applications in stainless steel production and battery technologies. Similarly, Samarium witnessed a price increase of 0.80 USD/KGS. While Zinc rose by 0.19 USD/KGS, underscoring the diverse market forces at play in the commodity sector during July.

These fluctuations in commodity rates signify the ever-changing dynamics of the global economy. As always, the metals markets remain unpredictable and subject to a range of factors. It will be interesting to see how they evolve in the coming months.

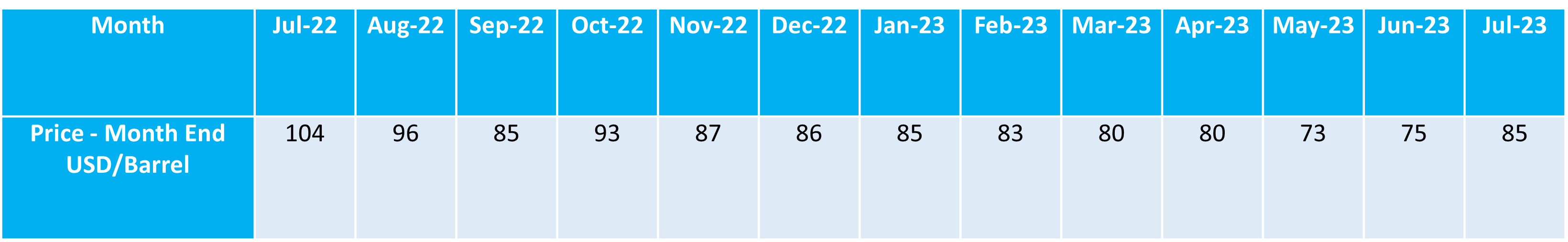

At the end of July, Brent Crude oil experienced a significant upswing. The commodity seen a notable increase of 10 USD per barrel. The sharp rise in price may be due to geopolitical tensions, supply constraints, changes in global demand, and other market dynamics.

We will continue to monitor the situation and keep you updated on any further developments.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity. Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight