Currency

The Pound to Dollar exchange rate’s technical setup has improved notably following a surge on Friday the 3rd. However, any further upside progress will be tested by this week’s UK GDP data release and speeches from the Bank of England’s Andrew Bailey and the U.S. Federal Reserve’s Jerome Powell this week.

Pound-Dollar rose by over a per cent on Friday following the release of softer-than-expected U.S. labour market figures that further lowered the odds of another U.S. interest rate hike and raised the prospects of rate cuts in 2024.

Technical analysts say the outlook for GBPUSD has now improved and are now looking for a test of the key 200-day moving average to signal a more decisive turn in trend that would favour further gains by Sterling.

“GBP/USD recently achieved the target for the H&S confirmed earlier and formed an interim low at 1.2035. The decline has paused, resulting in the formation of a small base,” says Kenneth Broux, a strategist at Société Genérale. “It would be interesting to see if the pair can gradually re-establish above the 200- DMA near 1.2440; this break would be essential to affirm an extended bounce. Inability to cross would mean persistence in down move. Next potential supports are located at 1.1980 and March low of 1.1800/1.1745,” says Broux.

GDP for the third quarter

The most important data release of the coming week will be that of UK GDP for the third quarter at 07:00 GMT on Friday. This will be a crucial piece of information for currency markets – that are fixated on growth differentials – to pass judgment on the Pound. The UK economy grew 0.2% quarter-on-quarter in the second quarter and 0.6% year-on-year. All signs point to a slowdown from these levels.

But ahead of the GDP release, we have the two heavy hitters at the Bank of England in the form of Governor Andrew Bailey and Chief Economist Huw Pill to look forward to.

Production & Freight Update

Last week, freight rates on the Asia-North Europe route saw an 8% increase. This leaves them just 5% below their 2019 levels, as per the Freightos Baltic Index (FBX). Nevertheless, this uptick is expected to be transitory. The HSBC Global Research report suggesting that container shipping rates are still in a declining trajectory. The report highlighted that the ongoing influx of new capacity into the market has dampened short-term rate prospects. Additionally, the highly anticipated peak season failed to deliver the expected boost and quickly lost momentum in driving up freight rates. HSBC also expressed caution regarding a rebound in inventory restocking. The report noted that despite optimistic industry statements about the end of inventory destocking, it remains uncertain whether businesses are keen to replenish their inventories robustly, especially given the potential slowdown in retail consumption, particularly following the resumption of student loan payments in the US in October.

Currently, Ningbo port is operating normally. The average vessel wait time is approx. 2-4 days, MSK have noted a shortage on the 20’ container availability. The space on the port remains tight due to being occupied by empty units.

Airfreight

Airfreight rates are on the rise, and airfreight indices have displayed substantial growth since October 1st. TAC Index data reveals that rates from China to Europe increased by 4.6% in the past month. Freightos’ FAX data presents even more notable increases, with a substantial 21% rise for South Asia to Europe in the 100kg to 300kg category. Chinese forwarders are confirming that the airfreight market has gained momentum. Airfreight rates have been gradually increasing week by week since the end of September. However, in the past few weeks, they have been surging. Forwarders are noting a shift in volume demand, emphasising the tightness of available space and the necessity for pre-booking. Interestingly, it has become uncommon to witness larger cargo in Shanghai commanding higher rates than smaller shipments. Thus, indicating that some airlines are finding it increasingly challenging to handle larger consignments.

The rate increases can be attributed to factors such as the influence of e-commerce and retailers rushing to replenish their Christmas stock. Although not universally applicable, many retailers saw their inventories finally decrease in the first half of the year after an extended period of being overstocked. The demand for Christmas shipments should sustain this “peak” with this trend likely to continue throughout this month and into early December.

Airport operations & hauliers are currently working as normal, with no flight cancellations or weather disruptions. Space is very tight due to a big launch of eCommerce cargo and the cargo for Black Friday.

Weather

It is all too clear with the recent news stories and images seen from the around the UK, that winter is fast approaching. With it the onslaught of extreme weather such as high winds, persistent rain, and cold temperatures that winter storms bring. Unfortunately, the extreme weather conditions can pose challenges for the logistics industry. Sudden and extreme weather changes can lead to disruptions and delays in freight movement planning.

Extreme weather conditions can profoundly disrupt maritime shipping operations. Storms can alter a ship’s planned route, causing passage delays and necessitating shelter-seeking for smaller vessels. These disruptions can lead to shipment delays and pose risks to cargo safety. Storms can result in route deviations, potentially causing delays in port arrivals, ports being bypassed, and missed connections. The ripple effect is felt at the destination port, where ensuing congestion creates additional hurdles, especially concerning feeder vessel connections. While modern vessels are better equipped to endure adverse conditions, they are not immune to the effects of severe weather.

Impact on UK Airports & Road Network

The productivity of UK airports is also affected during the winter months. Adverse weather conditions and shorter daylight hours can slow down the unloading of cargo from aircraft. In a sector where time is of the essence, even a one-hour delay can have significant ramifications. Poor weather conditions can lead to more cargo being offloaded from scheduled flights. Especially with budget airlines, where service punctuality may be less of a priority.

Extreme weather conditions inevitably have an adverse impact on the UK road network, causing additional congestion, especially on major transportation routes. Similar challenges can arise on major routes throughout Europe if severe weather conditions extend further afield.

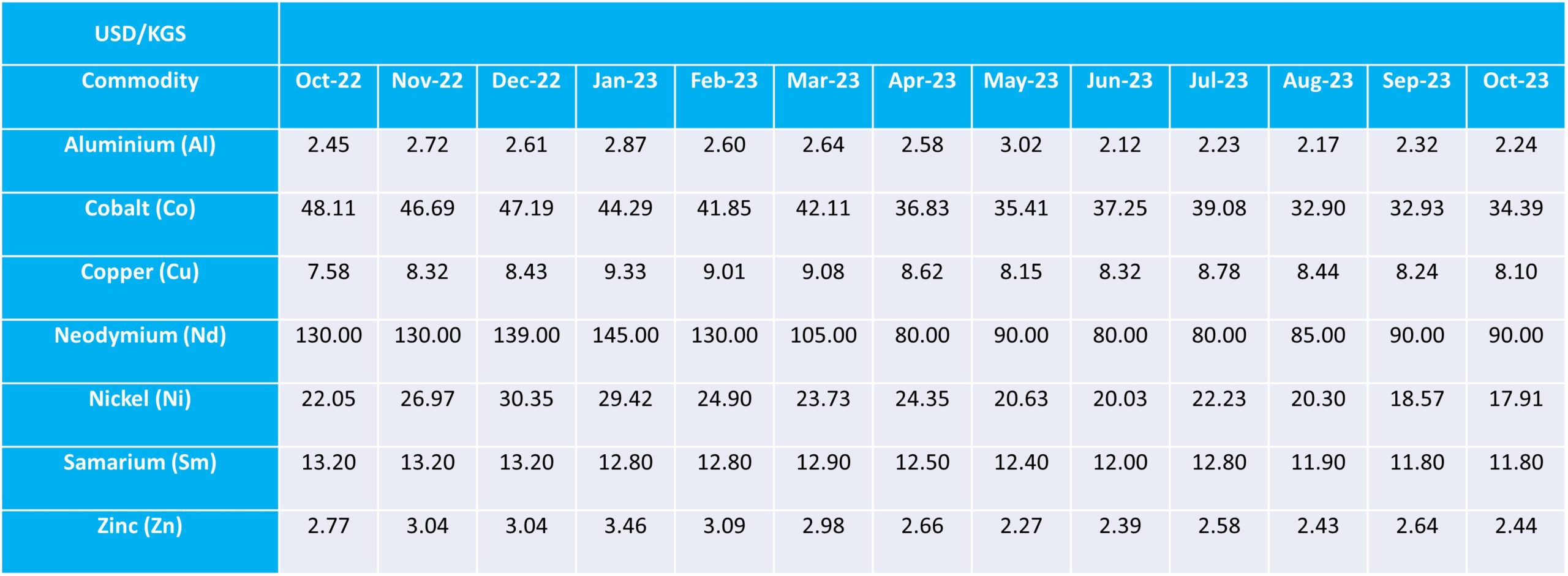

Commodity Rates

As the curtains closed on October, the commodity market exhibited a notable shift in the pricing landscape. Amidst these fluctuations, however, stood Neodymium and Samarium. The two rare earth metals critical for high-tech manufacturing and energy solutions, which remarkably held their ground.

Aluminium, a bellwether for economic activity due to its widespread use in everything from construction to consumer goods, witnessed a modest decrement of 0.08 USD/KGS, hinting at potential softening in manufacturing sectors. Copper—often regarded as a gauge of global economic health due to its extensive industrial applications—also retreated, falling by 0.14 USD/KGS. This decrease in copper prices might reflect an anticipation of reduced consumption or an improvement in supply situations. Nickel, vital for stainless steel and battery production, saw a more pronounced drop of 0.66 USD/KGS, which could potentially signal a surplus in production or easing of demand in stainless steel manufacturing. Zinc, employed for galvanisation and alloy production, experienced a dip of 0.20 USD/KGS.

In stark contrast to these metals, Cobalt climbed by 1.46 USD/KGS. The increased price of Cobalt, a critical component for rechargeable batteries and aerospace alloys, could be attributed to supply constraints or heightened demand from the battery sector, possibly driven by sustained growth in the electric vehicle market or electronic device production. This uptick in Cobalt’s price highlights the complex interplay of market forces that differentially affects commodity prices, even within the metals sector.

As October drew to a close, Brent Crude Oil, registered a significant decrease, shedding 7 USD per barrel. This considerable drop in price reflects a confluence of factors possibly including a tempered demand outlook, perhaps due to global economic headwinds or the resurgence of concerns over energy efficiency and alternative fuels.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity. Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.