Welcome to the Goudsmit UK Market Update for May! As we navigate through the intricate landscape of global trade, this month’s update brings insights into the latest trends and developments shaping various sectors. From currency fluctuations to commodity market shifts, production and freight updates, stay informed with our comprehensive analysis.

Currency:

The average GBP/USD exchange rate in April 2024 was 1.251. Looking ahead, the primary catalyst of movement for the exchange rate this week will undoubtedly be the Bank of England’s upcoming interest rate decision.

The central bank is widely expected to keep interest rates on hold during this meeting at 5.25%. Markets are currently pricing in the first rate cut to arrive in September 24, so any dovish tilt from BoE policymakers could see markets reprice their current bets and undermine GBP.

Moving into Friday, the UK’s preliminary GDP data for the first quarter of 2024 is expected to show that the economy expanded by 0.4% and has grown from a 0.3% contraction in 2023’s fourth quarter.

Should the data match expectations, this will likely see the Pound firm against its counterparts this month.

May Production & Freight Update:

Geopolitical volatility remains the focus in this area. The Russo-Ukrainian war continues with no end in sight, and Israel this week have rejected the latest Hamas offer for cease-fire.

Rogier Vervoort, owner and managing director of Dutch Container Merchants, has advised “that only a cease-fire in the Gaza region could bring some stabilization into this area”.

Ocean Rates:

Last week, the Shanghai Containerized Freight Index reached its highest point since September 2022, indicating the rising expenses of redirecting vessels around the Cape of Good Hope in Africa.

Container xChange noted that “traders in China are witnessing significant volatility, with new container prices emerging every 48 hours, reflecting the market’s sensitivity to geopolitical tensions and uncertainties. Depots in the US and Europe are reporting higher utilisation rates, with increased equipment usage fees and storage rental charges since the Houthi attacks began in November.”

Port & Air Operations:

In Ningbo, port operations are currently running as normal, with a vessel waiting time of 2-4 days and no weather disruptions. Capacity is normal; however, some carriers are experiencing a shortage of 40’ HQ containers.

Airport operations & hauliers are currently working as normal, with no flight cancellations or weather disruptions. Space is tight at the moment which is one of the driving factors keeping rates high.

Increasing Air Cargo Rates:

There is an intricate relationship between maritime disruptions and the subsequent ramifications on airfreight dynamics in the current global logistics landscape.

Resurgent demand for air cargo and increasing rates, fuelled by disruptions in Red Sea shipping and robust bookings from Chinese e-commerce platforms during a traditionally slow period for shipping, are setting high expectations among air carriers for the upcoming peak season.

However, this surge in demand is also causing concern among logistics providers who are worried about securing enough capacity.

Air cargo demand has experienced double-digit growth for four consecutive months, while rates have steadily risen since late February. This has surprised industry observers after a prolonged downturn that hit bottom in August last year.

This recovery is uneven across regions and can be partly attributed to a weaker performance in 2023, which makes the current comparison appear stronger.

The growth in air cargo is primarily driven by factors such as poor reliability in ocean shipping. The increasing influence of Chinese e-commerce giants like Shein, Temu, and Alibaba is also contributing.

This demand surge is putting pressure on capacity, with some airlines already selling out their commitments for flights from China and Hong Kong to the US and Europe for the year.

While the airfreight industry is experiencing a stronger-than-expected start to 2024, concerns persist regarding potential disruptions, such as a regional conflict or the ongoing challenges in certain trade lanes – particularly those impacted by the Red Sea blockade.

Key Statistics Highlighting Increasing Airfreight & Shipping Trends:

The magnitude of developments is underscored in these key statistics:

- Airfreight volume increased by 11% year over year in March, according to rate benchmarking platform Xeneta, maintaining remarkable consistency at 11% growth in January and February as well.

- Flight activity for cargo jets increased by 6.2% in the first quarter of the year – the first growth in two years.

- Average global airfreight spot rate in March soared by 7% from the previous month, reflecting the tightening capacity and increased demand.

- The global shipping price, at about $2.55/kg, has surged by 40% above pre-COVID levels.

These figures highlight the unprecedented challenges and opportunities facing the air cargo industry amidst a rapidly evolving global landscape.

Striking a Balance Between Supply Chain Efficiency & Resilience:

In the past, supply chains aimed for efficiency by using Just-in-Time methods to cut costs and optimize resources. This was largely due to the belief that a smooth process led to a successful supply chain.

However, after major global events in recent years, such as the pandemic in 2020/21 and the geopolitical tensions between Russia and the Ukraine, and the recent Red Sea terrorist attacks, the downside of overly efficient supply chains has been exposed.

It has become clear that there is a need to balance efficiency with resilience in supply chain management.

Striking the right balance between resilience and agility is now crucial and the industry has seen a shift from a strict focus on efficiency to a more resilient approach. Businesses are reevaluating their supply chain strategies to prioritize adaptability over strict efficiency.

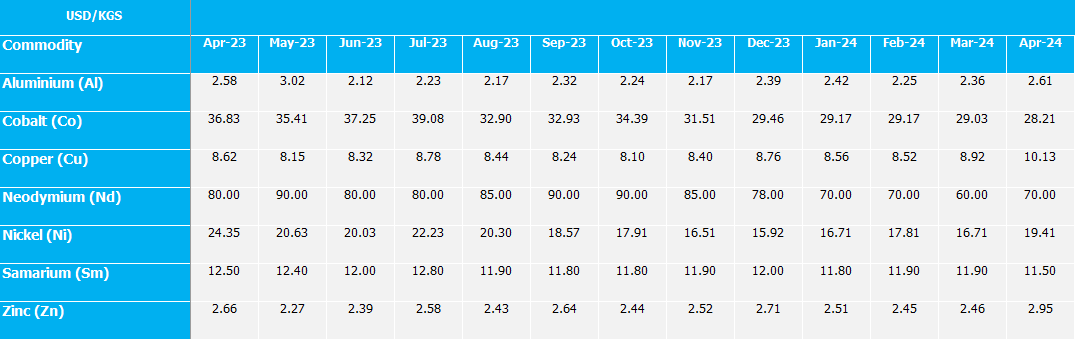

Commodity Market:

April was characterised by an increase in commodity prices across several key sectors. Aluminium, Copper, Neodymium, Nickel, and Zinc all experienced notable upticks.

Neodymium rebounded from a decrease in March to return to its January and February level of 70$ USD/KG, while Nickel surged to its highest rate since August 23, reaching 19.41$ USD/KG. However, slight declines were observed in Cobalt, dropping by 0.82$ USD/KG, and Samarium, which saw a modest decrease from 11.90$ USD/KG to 11.50$ USD/KG.

This fluctuation reflects the dynamic nature of commodity markets, influenced by global demand, geopolitical tensions, and supply chain disruptions.

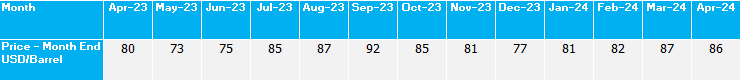

April also saw a marginal decrease in Brent crude oil price, dropping by $1 USD, yet remaining at higher price ($86 USD per barrel) than the previous two quarters. The slight decrease in Brent crude prices in April, albeit marginal, holds implications across various sectors.

The fluctuating cost of oil underscores the importance of resilience and foresight in mitigating risks and capitalizing on opportunities in an ever-evolving global economy.

Download the latest Commodity Rates.

Goudsmit UK Response:

Goudsmit UK continue to communicate with all customers proactively, fostering our long-term partnerships, managing expectations, and providing multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

Freight forwarders are trying their best to move goods on schedule without additional fees. However, in this unstable period, delays and additional charges can occur out of forwarders’ control.

We therefore continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning.

We would request that you review your current requirements, and your requirements for 2024 and into 2025, at the earliest opportunity. Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer, and would encourage that a minimum of 8-10 months of buffer stock is considered when re-ordering new production. This helps to reduce the impact of freight delays and lessen the potential requirement for costly airfreight.