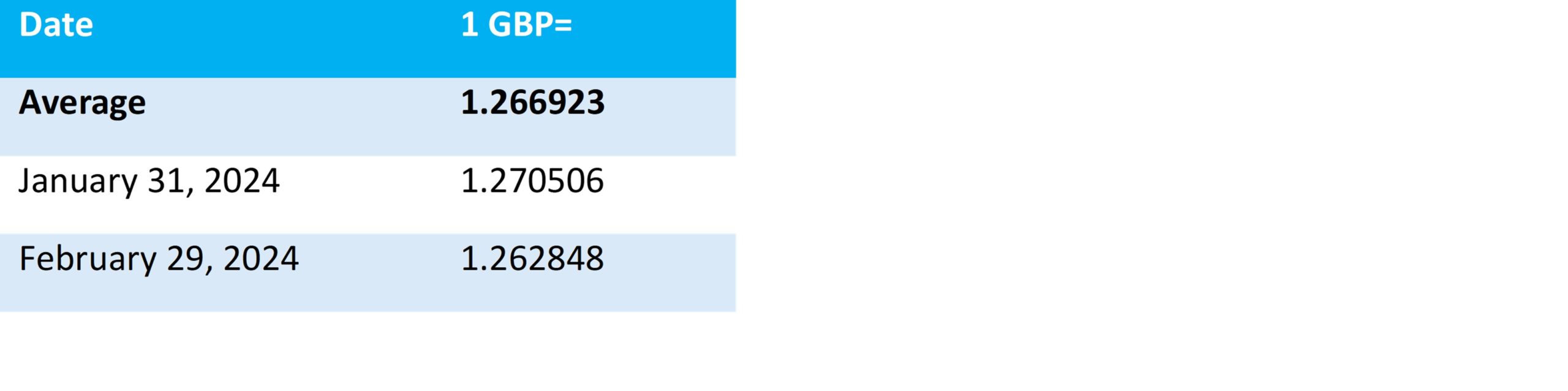

Currency

The British Pound starts a busy week with gains against a United States Dollar still feeling the pressure from last week’s news of a sharper-than-expected contraction in the manufacturing sector. Most of the big scheduled news for GBP/USD will come from the ‘USD’ side of things in the coming days, but Sterling’s will likely see some interest generated by Wednesday’s Spring Budget from Chancellor of the Exchequer Jeremy Hunt.

The contents of the budget remain up in the air. However, Chancellor Hunt has been eyeing potential tax cuts. With the headroom for any cuts having shrunk notably in recent times, any tax reductions could undermine Sterling.

Looking ahead for the US Dollar, all eyes will be on Federal Reserve Chair Jerome Powell’s testimony, this week. Powell is expected to discuss monetary policy with a bipartisan committee and may face pressure to begin cutting interest rates. If Powell maintains a hawkish outlook and pushes back against these expectations, the ‘Greenback’ could climb. However, if he opens the door to rate cuts, USD could slump against its peers. Additionally, the latest JOLTs job openings data is due to print on Wednesday. In January, the number of jobs created is forecast to have fallen to 8.9 million, which may weigh on USD exchange rates.

GBP to USD Historical Rates

Production & Freight Update

Despite assessments indicating that US and UK strikes have considerably weakened Houthi capabilities, attacks in the Red Sea persist. Ongoing US and UK strikes on Houthi positions, along with the potential implementation of maritime sanctions by the US Federal Maritime Commission on Yemen, contribute to rising insurance premiums for vessels transiting the Red Sea.

Global liner majors’ schedule reliability is on a downward trend due to the ongoing Red Sea crisis, as per the latest report by Sea-Intelligence. Covering 34 trade lanes and 60+ carriers, the report indicates a -5.1% point drop in January 2024. Therefore, reaching the lowest score since September 2022 at 51.6%. The Red Sea crisis has led to delays in vessel arrivals, increasing by 0.59 days to 6.01 days. The overall situation shows a narrowing gap in reliability between carriers and a lack of month-on-month improvements. Only seven carriers showed a year-on-year improvement in schedule reliability.

To try to improve schedules and reliability, CMA CGM Group, the world’s third-largest container liner, announced a reassessment of conditions in the Southern Area of the Red Sea. They are now allowing transit on a case-by-case basis, evaluating each vessel’s route individually. While other vessels will still be rerouted via the Cape of Good Hope. This decision follows the company’s cessation of Red Sea transits on February 1st, prioritising crew safety after a missile attack on one of their container ships. The company aims to cautiously resume transit to navigate the unpredictable situation while safeguarding operations and personnel.

Ocean Rates

While ocean rates remained stable overall last week, Red Sea diversions are keeping prices elevated. Though they are gradually decreasing from their peaks. Rates from Asia to North Europe have declined by 17% since mid-January. Although post-Lunar New Year backlogs may temporarily sustain elevated rates, ocean freight is expected to enter a slow season in the coming weeks. Therefore, leading to likely declines. Despite diversions and carriers passing on higher costs, the European Shipping Council suggests that ocean rates and surcharges for Red Sea diversions are surpassing carriers’ increased costs. In turn, indicating a potential decrease in ocean prices from current levels. The impact of diversions on capacity, equipment availability, and ocean prices for non-Red Sea lanes may have peaked.

Container Volumes

The demand for transporting empty containers is surging much faster than for full ones, especially in back-haul trades growing 2½ times quicker. Recent data from Container Trade Statistics (CTS) reveals about a 20% increase in empty container volumes compared to 2019. This rising demand for moving empty containers is increasing expenses for head-haul containers (the leg of the trade route with the highest container volume). Thus, suggesting shippers in head-haul trades may face a growing burden covering the costs of moving empty containers in the future.

In the past, supply chains aimed for efficiency by using Just-in-Time (JIT) methods to cut costs and optimise resources,. This is under the belief that a smooth process led to a successful supply chain.

However, after major global events in recent years, such as the pandemic in 2020/21 and the geopolitical tensions between Russia and the Ukraine, and the recent Red Sea terrorist attacks, the downside of overly efficient supply chains has been exposed. It has become clear that there is a need to balance efficiency with resilience in supply chain management. Striking the right balance between resilience and agility is now crucial. Moreover, the industry has seen a shift from a strict focus on efficiency to a more resilient approach. Businesses are reevaluating their supply chain strategies to prioritize adaptability over strict efficiency.

Port & Air Operations

In Ningbo, port operations are currently running as normal. Vessel waiting times are 2-4 days and no weather disruptions. Equipment availability and capacity are returning to normal levels.

There is an intricate relationship between maritime disruptions and the subsequent ramifications on airfreight dynamics in the current global logistics landscape. Airfreight has seen a rise in demand as a result of the Red Sea conflict impact on Suez Canal shipping. The prevailing situation is characterised as volatile, leading to:

- Elevated freight rates

- Extended transit times

- Disruptions in the supply chain

Thereby exerting pressure on airfreight capacity. The extended ocean transit times are expected to impact inventories significantly, causing an immediate effect on airfreight capacities. It is anticipated that there will be substantial price hikes on major trade routes due to these challenges. Therefore, creating a dynamic where airfreight becomes more essential in meeting urgent delivery timelines.

In air cargo, although rates out of Asia and the Middle East stabilised or eased on most lanes last week, China to North America prices rebounded to $4.80/kg. Thus, reflecting a potential increase in demand post-Lunar New Year.

Airport operations & hauliers are currently working as normal, with no flight cancellations or weather disruptions. Following the conclusion of the Chinese New Year holiday, certain factories have experienced delays in resuming operations. In turn leading to a decrease in export volume. It is anticipated that the volume will rebound to normal levels starting next week.

Weather

The primary driver of significant disruptions in supply chains for the upcoming year is anticipated to be weather-related incidents, including:

- Hurricanes

- Winter storms

- Wildfires

- Floods

This forecast, derived from Everstream Analytics’ annual 2024 Risk Report, underscores that extreme weather events are poised to surpass other factors such as environmental regulations and trade wars. The report relies on a robust database encompassing both known and predicted events. Leveraging a blend of human intelligence and advanced AI technology. This combination enables a comprehensive assessment of the potential risks and challenges faced by supply chains. Thus, emphasising the increasing significance of climate-related disruptions as a key determinant in shaping the resilience of global logistics networks.

Impact on Shipping

The impact of extreme weather on maritime shipping operations is profound. Storms have the potential to alter planned routes, leading to delays in passage and necessitating smaller vessels to seek shelter. Such disruptions pose risks to cargo safety and result in shipment delays. Route deviations can cause delays in port arrivals, instances of ports being bypassed, and missed connections. Thus, creating a ripple effect that exacerbates congestion at destination ports. Despite the advancements in vessel technology to withstand adverse conditions, they remain susceptible to the effects of severe weather.

Impact on UK Airports & Road Networks

The productivity of UK airports is not exempt from the challenges of weather extremes. Adverse weather conditions and reduced daylight hours can impede the timely unloading of cargo from aircraft. In an industry where time is of the essence, even a one-hour delay can have significant consequences. Particularly for budget airlines where service punctuality may be less prioritised.

Extreme weather conditions also cast a shadow over the UK road network, causing additional congestion, especially on major transportation routes. Similar challenges extend across major routes in Europe when severe weather conditions prevail beyond the UK borders. The logistics industry must navigate these seasonal challenges to ensure the smooth flow of goods amidst the unpredictable winter weather.

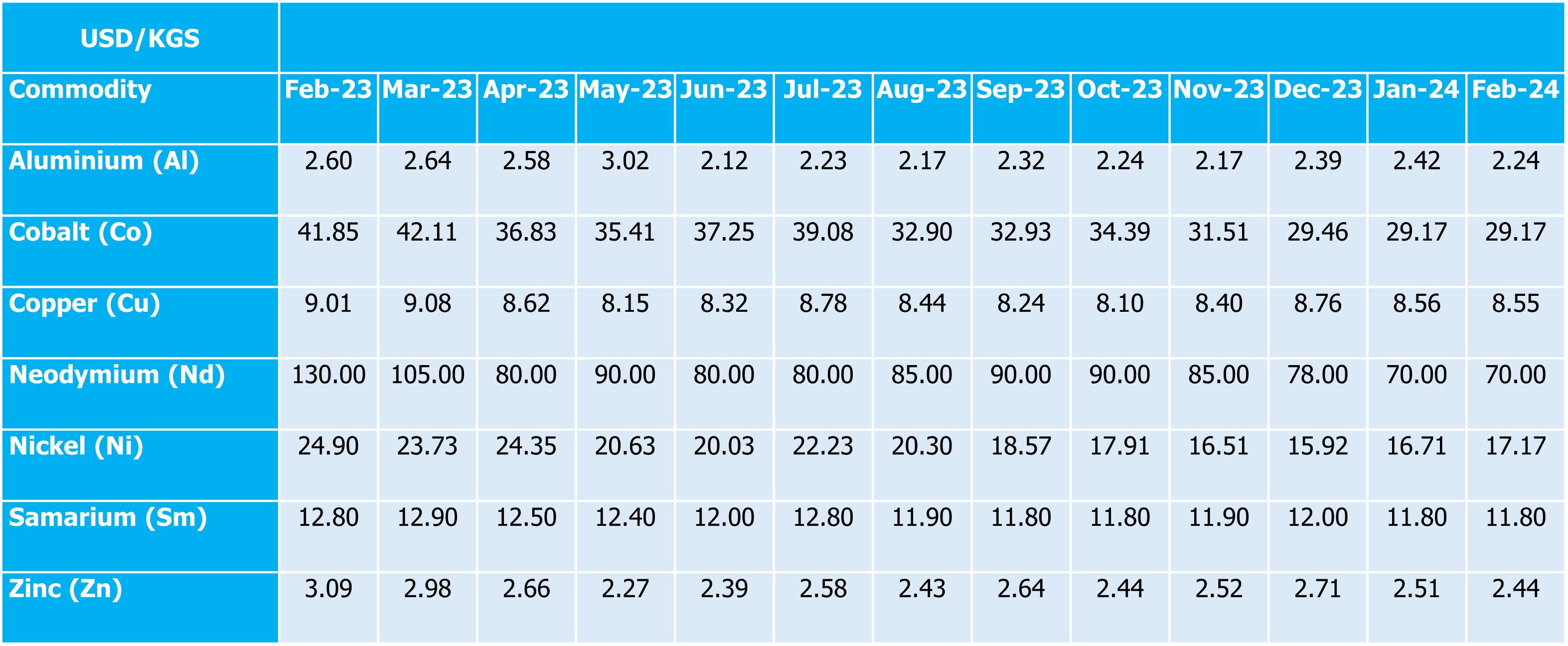

Commodity Market Stability

Among the tracked metals, Nickel stood out with a slight increase of $0.46 per kilogram, marking the only increase in the portfolio. This contrasts with the commodity market stability observed in the prices of Cobalt, Neodymium, and Samarium, which remained unchanged. Thus, indicating a period of market steadiness for these materials. However, Aluminium, Zinc, and Copper experienced decreases in their valuations. Aluminium saw a reduction of $0.18 per kilogram, Zinc’s price dipped by $0.07 per kilogram, and Copper edged down by a minimal $0.01 per kilogram. This blend of commodity market stability and modest fluctuations underscores the varied performance across the tracked commodities in the current market environment.

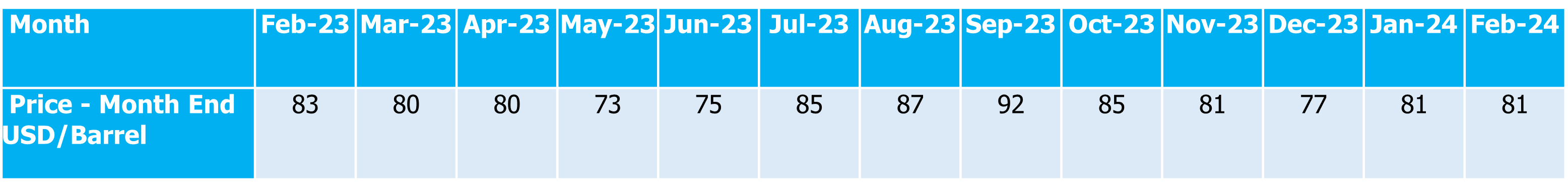

In the commodities market, Brent crude oil showcased a notable stability as it closed the month of February without any change in its price. This commodity market stability is significant, highlighting a period of equilibrium in the oil market amidst fluctuating global economic indicators and geopolitical tensions that often influence commodity prices. The steadiness of Brent crude oil’s price at month’s end underscores the balancing act between supply and demand dynamics, regulatory influences, and investor sentiments. This unaltered price level indicates a momentary pause in the usual volatility associated with the oil markets, providing a temporary predictability for investors and industry stakeholders alike. Such periods of commodity market stability, though rare, offer a reflective pause in the otherwise turbulent energy sector, suggesting a cautious anticipation of future market movements.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively, fostering our long-term partnerships, managing expectations, and providing multiple solutions. In turn, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

Freight forwarders are trying their best to move goods on schedule without additional fees, but in this unstable period, delays and additional charges can occur out of forwarders’ control. We therefore continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap and would urge you to review your requirements for 2024 and in to 2025, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.