Currency

Another busy week is expected for the FX markets, with many key risk events and macro-economic data due to be released.

The pound retraced part of its gains as investors are now worried that higher interest rates from the Bank of England are going to dampen economic activities in the United Kingdom. According to the NatWest markets forecast for the next 6 months, a recession in the UK is now a real possibility and a worry for the winter months, with inflation remaining increasingly stubborn.

Nevertheless, the GBP looks well-supported as inflationary pressures are stuck above 8.5% and showing no signs of easing despite the restrictive monetary policy. Looking forward, investors are shifting their focus towards global PMI numbers to assess the impact of interest rates. Markets are forecasting manufacturing PMIs in the United Kingdom for June to show stability but would still remain in contraction territory. Ultimately, whether the GBP rally can be sustained remains under debate as rising borrowing costs point to hardships for households and businesses.

Ultimately, as tensions across France and Europe rise and economic data continues to evidence a struggling eurozone economy, many analysts are reluctant to take a position on the bloc’s single currency until further clarity prevails on the continents underlying economic and socio-political health.

Production Update

Developed nations are continuing to grapple with inflationary and recessionary pressures. In response, major central banks are actively implementing measures such as raising interest rates. Alongside reducing their asset holdings, in an orchestrated attempt to combat inflation. Consequently, financial conditions are becoming more restrictive.

Chinese manufacturing continues to experience a contraction as the global demand outlook shows little indication of short-term improvement.

Freight Update

A robust Chinese economy establishes a positive feedback loop for ocean shipping. The production of goods fills container ships and car carriers during their outbound journey. While simultaneously generating demand for bulk commodities that fill bulkers and tankers during their inbound voyage.

As Western demand for Chinese containerised exports declines, the anticipated post-COVID recovery in Chinese domestic spending has also showed signs of weakness.

While there is still anticipation of Chinese stimulus measures, a growing sentiment suggests that it may not be substantial enough or focused on raw materials to significantly revitalise bulk commodity shipping rates. Despite their efforts, they appear to be unable to raise freight rates. This is due to persistently low demand and insufficient cancellation of sailings by carriers.

Container xChange data shows how far the prices of 20-foot containers have dropped globally over the last number of years. Taking Ningbo port for example, where they were seeing rates of $2298 in June 2021, down to $1289 in June 2023.

However, as freight rates continue to be evaluated in both pandemic and pre-pandemic contexts, it appears unlikely that a return to pre-pandemic levels will occur. This is primarily due to the escalation in costs, which has led to an upward adjustment of minimum pricing.

Currently, most ports in China are operating without any significant issues. However, vessel space is tight at Ningbo port due to a high number of empty units occupying dock space and the current waiting time is approximately 2-4 days.

Air Freight

Airfreight rates declined again in June as the quieter summer period resulted in a demand slowdown. The decline observed between May and June is a regular occurrence throughout the year. Demand typically decreases during the summer season while capacity rises due to the addition of bellyhold capacity for summer operations.

During the summer months, prices tend to gradually decrease before showing signs of improvement in September. Therefore, anticipating the onset of the summer peak season.

However, the decrease in rates compared to the previous year is indicative of the current market’s weakened conditions. Although, the decline appears to have stabilised at this point.

SGL expressed the belief that supply would surpass demand in the foreseeable future. They noted that capacity supply would slightly decrease following the summer holiday period. This is primarily due to a reduction in passenger flights. However, this decrease is not expected to significantly impact the overall supply and demand dynamics. The statement highlighted that a demand upturn is contingent upon favorable changes in the macro and geo-political environment. Additionally, the decreasing inflation levels were expected to have some positive influence. Some analysts also suggested that the drastic reduction in inventory levels might have been excessive. Therefore, potentially leading to a surge in airfreight demand. In essence, the situation remains in a state of uncertainty or limbo, awaiting further developments.

Airport operations are currently experiencing stability, with no flight cancellations or weather disruptions. The market is continuing its period of stability, with no major fluctuations in freight rates.

Brexit

Since the UK’s departure from the EU’s Single Market and Customs Union, over two and a half years have passed. In turn, revealing increasingly apparent negative consequences of Brexit on UK trade and the labour market. In terms of trade, once pandemic-related effects are accounted for, there is clear evidence of a significant reduction in EU-UK trade in both directions. However, there is a possibility of partial recovery over time as UK and EU businesses fully adapt to the new environment.

The share of trade in relation to GDP has also declined. Resulting in numerous small and medium-sized UK companies have withdrawn from engaging in trade with the EU. On the labour market front, the cessation of free movement for EU citizens has contributed to a recent upsurge in labour shortages. In particular, in sectors employing lower-skilled workers. Nonetheless, other factors beyond Brexit may have played a more substantial role in the decline of UK labour force participation. The long-term impacts remain uncertain. This includes how the slowdown in EU trade and migration might affect potential labour supply and future productivity.

Northern Ireland

Northern Ireland continues to lack a functioning government as the Democratic Unionist Party (DUP) withdrew its participation in protest the post-Brexit trading arrangements for the region. While the UK and EU reached the Windsor Framework to streamline procedures for goods entering Northern Ireland from Britain earlier in the year, the DUP is seeking further assurances.

However, the DUP has faced significant criticism, as many now believe that with the new Windsor Framework, Northern Ireland is in a highly advantageous position.

Despite the absence of local ministers, the responsibility of setting Northern Ireland’s budget for 2023/24 has fallen on the current Secretary of State for Northern Ireland, Chris Heaton-Harris. In addition, senior civil servants have taken on the task of managing departments in the region.

However, the financial situation is deteriorating, with many civil servants expressing the need for substantial additional funding, amounting to hundreds of millions of pounds, to sustain public services at their present level.

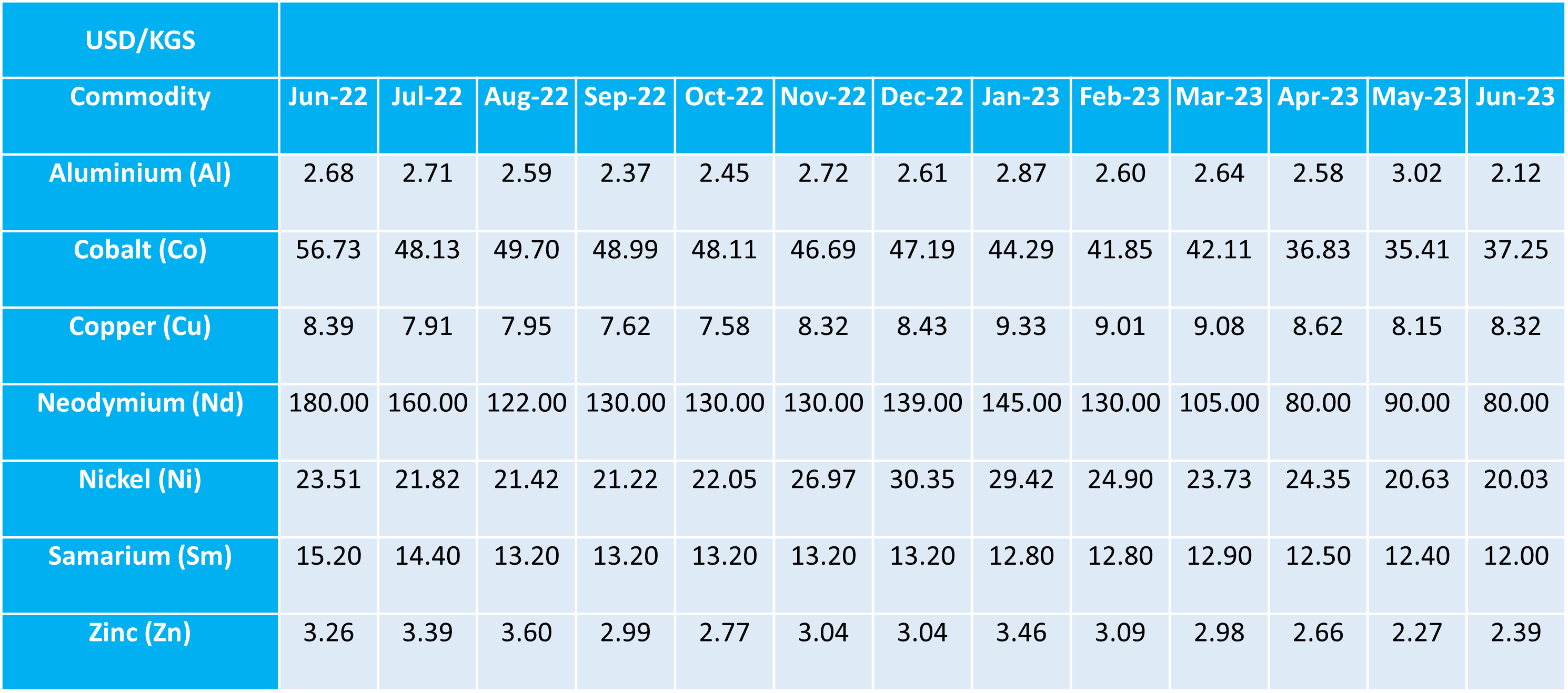

Commodity Rates

In the month of June, the tracked commodity rates experienced various fluctuations, with notable changes observed across several metals. Neodymium, a highly sought-after rare earth element, saw a significant drop of 10 USD/KGS in its price. Similarly, Aluminum experienced a decrease of 0.90 USD/KGS. While Nickel recorded a decline of 0.60 USD/KGS, and Samarium witnessed a decrease of 0.40 USD/KGS. On the other hand, certain metals exhibited price increases during this period. Cobalt, a crucial component in electric vehicle batteries, noted a notable increase of 1.84 USD/KGS. Copper, an essential metal used in various industries, saw a modest rise of 0.17 USD/KGS. Zinc, another important industrial metal, experienced a marginal increase of 0.12 USD/KGS. These fluctuations in commodity rates during June reflect the dynamic nature of global markets. Furthermore, they can have implications for industries relying on these metals for manufacturing and production processes.

As always, the metals markets remain unpredictable and subject to a range of factors.

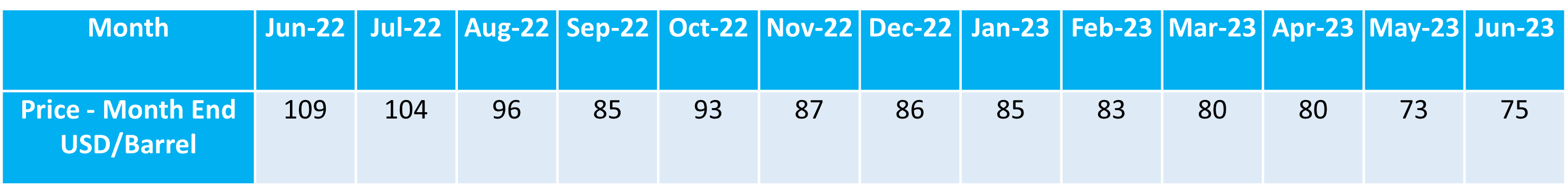

At the end of June, Brent Crude oil experienced a notable decline, with a drop of 2 USD per barrel. Brent Crude is a benchmark for global oil prices and is closely monitored by market participants and investors. The decrease in price can be attributed to various factors such as changes in global demand and supply dynamics, geopolitical developments, and market sentiment. A drop in Brent Crude oil price can have significant implications for the energy industry. It affects the profitability of oil producers, the cost of transportation, and ultimately impacts consumer prices for various petroleum products. We will continue to monitor the situation and keep you updated on any further developments.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.