Currency

GBP has spent the last 2 weeks recovering from a dip, after global markets took a small wobble in reaction to the Delta variant spread across the globe. However, cases of infection and number of deaths have continued to drop on a daily basis. In turn, allowing GBP to recover some ground.

GBP investors will now look ahead to this Thursday’s Bank of England meeting. This will see the release of the latest macroeconomic projections and quarterly Inflation report, alongside the interest rate decision announcement. With prices rising more than expected over the past few months, a modest upward revision to the inflation forecast could well be on the cards. Although, it is expected that growth projections will remain unchanged.

With uncertainties surrounding the spread of the delta variant around the world still lingering in the background, it may be deemed too early for the BoE to outline plans to both end its QE programme and raise interest rates. Most MPC members still appear to have the opinion that the recent spike in prices will be temporary and contained within around 3-3.5%.

A number of analysts are suggesting that GBP could be ‘vulnerable’ to a Bank of England disappointment, with the potential for a cautious communications emphasising the need for patience, which would ultimately weigh on the pound. On the flip-side, there is a chance that some of the more hawkish committee members, such as Ramsden and Saunders, see things differently and may vote for a winding down in asset purchases. This would likely be a bullish signal for Sterling.

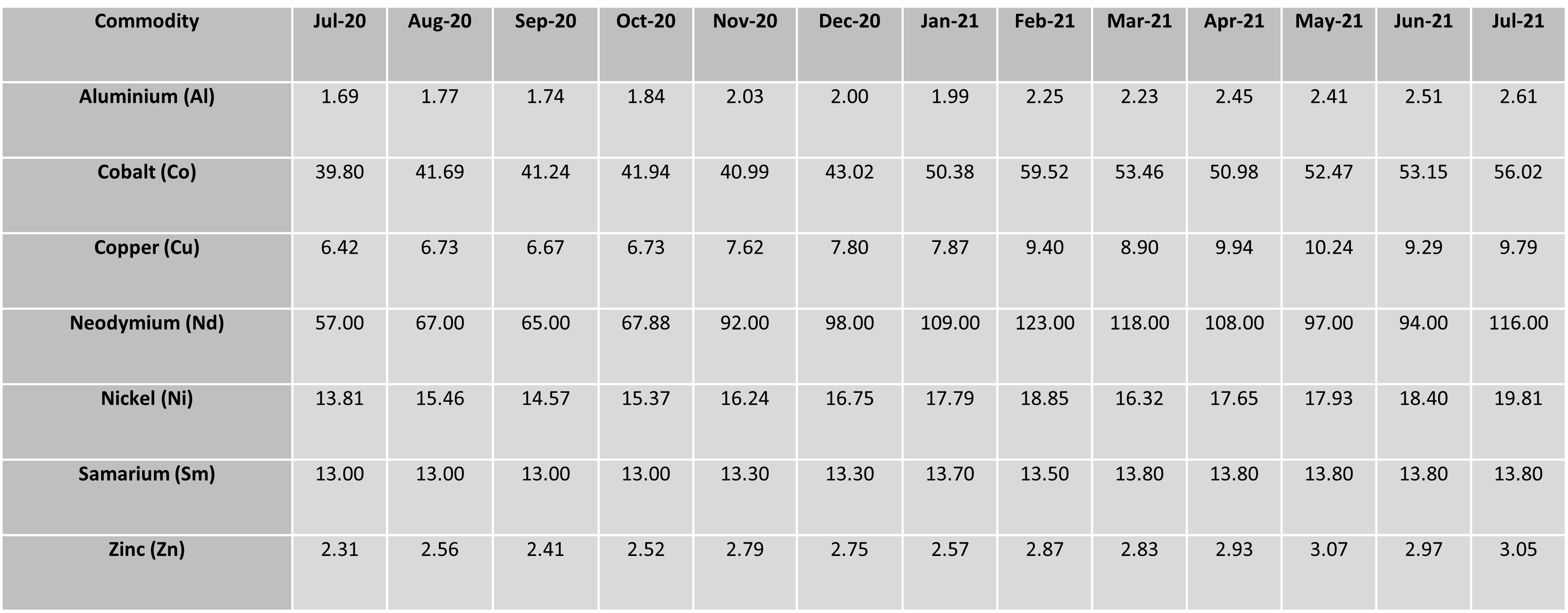

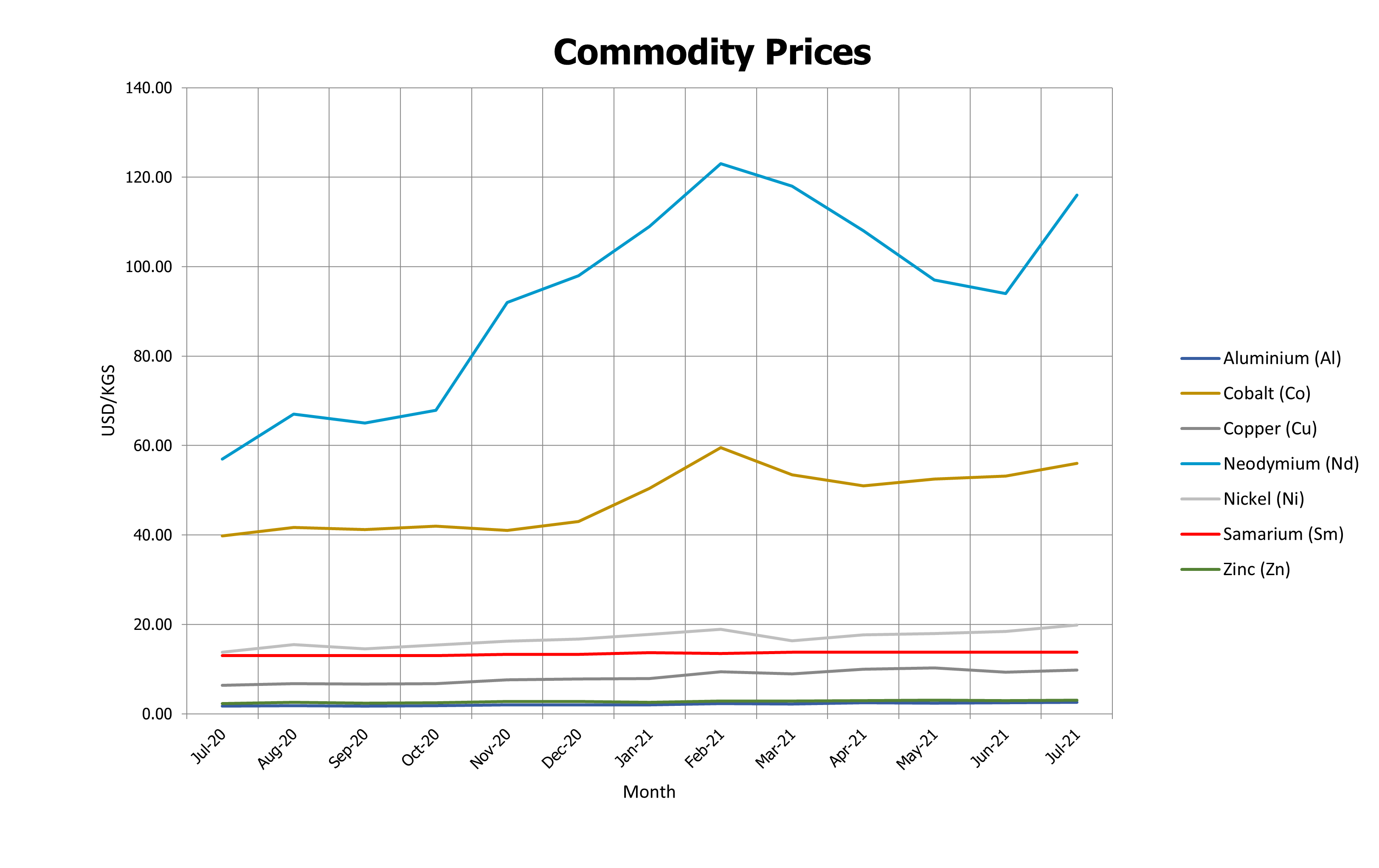

Commodities

In the month of July, all commodities saw an increase aside from Samarium which remained at 13.80 (USD/KGS). Neodymium had a significant increase of 22 (USD/KGS). Cobalt had an increase of 2.87 (USD/KGS), Nickel 1.41 (USD/KGS) and Copper 0.50 (USD/KGS). Aluminium increased by 0.10 (USD/KGS) closely followed by Zinc with a 0.08 (USD/KGS).

Sea Freight

Freight costs are continuing to be a major concern as rising fuel costs, tighter vessel supply and longer port turnaround times amid COVID-19 curbs are causing decade-highs. Competition for space remains high, and pricing remains between 3 & 5 times more than normal for this time of the year. Although the number of blank sailings has dropped, the issues are still nowhere nearer to getting resolved.

Air Freight

July saw no signs of recovery in aircraft capacity, so airlines are having to micromanage flights as international uncertainty remains. Rates have continued to decline from the end of May. This slow decline may cause airlines to take cargo only capacity out of the market as passenger operations start to pick up.

Brexit

The UK continues to negotiate trade agreements with individual countries. May’s deal with Norway, that had been agreed in principle, has now been signed off along with Iceland and Liechtenstein. These free trade deals have locked in tariff-free trade and secured greater access for UK firms.

Goudsmit UK

At Goudsmit UK, we use a number of different freight partners to transport our customers products globally. This multi-carrier approach allows us to select the carrier best suited to your requirements, providing flexibility and a tailored service.

Whilst freight delays are unavoidable at this time, we work with our customers by holding UK stock. We would encourage that 6-8mths of buffer stock is considered when re-ordering new production. This helps to reduce the impact of potential freight delays and lessening the potential requirement of costly airfreight.