Currency

The British pound managed to find some support toward the end of last week after the British economy grew faster than expected. However, the support could turn out to be short-lived.

Despite the tightening in financial conditions, the US economy is proving to be far more resilient compared with some of its peers. Thus, allowing the US Federal Reserve to stay hawkish for longer. In contrast, the Euro area and the UK are experiencing sluggish growth as elevated interest rates spill over to the economy.

Further weakness could drag GBP/USD to the 1.2000 zone in the next few weeks. Note UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia.

Key Quotes

24-hour view: After GBP rose to a high of 1.2271 last Friday, we indicated yesterday that “the short-lived advance did not lead to any buildup in momentum, and GBP is unlikely to advance further”. We expected GBP to consolidate in a range of 1.2145/1.2255. Instead of consolidating, GBP plunged to a low of 1.2086. While severely oversold, there is room for GBP to weaken further. However, the major support at 1.2000 is likely out of reach for now (there is another support at 1.2050). On the upside, if GBP breaks above 1.2155 (minor resistance is at 1.2120), it would mean that the weakness in GBP has stabilised.

Next 1-3 weeks: Our most recent narrative was from last Friday (29 Sep, spot at 1.2200), wherein the recent month-long weakness has ended. GBP could consolidate in a range of 1.2100/1.2380 for the time being. We did not expect GBP to drop below 1.2100 so quickly, as it plummeted to a low of 1.2086 in NY trade. The rapid decline suggests that the weakness in GBP has resumed, likely towards 1.2000. In order to maintain the momentum buildup, GBP must not move above 1.2190, the current of ‘strong resistance’ level.

Sources FX Street

Production & Freight Update

China freight rates in September 2023 were relatively stable, but with a slight downward trend. The average spot rate for a 40-foot container from Shanghai to Rotterdam was $1,052, according to the Freightos Baltic Index (FBX). This is down from $1,100 in August 2023.

The factors influencing China freight rates in September 2023 were demand, capacity and port congestion. Demand for Chinese goods has slowed in recent months. This is due to several factors, including the global economic slowdown, inflation, and the war in Ukraine. Shipping lines have increased their capacity on the China-Europe trade lane. Also, port congestion has eased in recent months, all helping to lower freight rates.

The start of October brings Golden Week, which is a week-long national holiday in China. It’s one of the busiest travel times of the year in the country. This as people take advantage of the break to visit family and friends, and to go on vacation. While Golden Week is a time of celebration for many, it’s also a challenging time for the shipping industry. Many factories and businesses close completely for the holiday, and those that remain open often operate at reduced capacity. This can lead to delays in production and shipments. As demand for shipments drop, carriers announce blank sailings, cancelling scheduled voyages to avoid flooding the market with excess capacity and to address the supply-demand imbalance.

In addition, the surge in domestic travel during Golden Week can put a strain on transportation networks. In turn, making it difficult to move goods around the country. This can also lead to delays and higher costs for businesses that need to transport their products during this time. Although the holiday only lasts one week, the effects are felt for several weeks either side.

This year however, the seasonal demand has been gradually weakening over the past four weeks leading up to China’s Golden Week holiday. It’s anticipated that the weakening trend will reach its lowest point during this week, as reported by MSI. In a broader context, MSI has declared that the peak season has already come to a close.

The outlook for China freight rates in the coming months is uncertain. Some experts believe that rates could continue to decline, while others believe that they could start to rise again. This will depend on a number of factors, including the global economic outlook, demand for Chinese goods, and port congestion. Currently, Ningbo port is operating normally. The average vessel wait time is approx. 2-4 days, with good equipment availability. However, the space on the port is tight due to being occupied by empty units.

In the air cargo market, the upcoming peak season for airfreight, is expected to pick up momentum following the Golden Week holiday in China. It appears to be moving forward sluggishly, mirroring the pace of the past few months. Freight forwarders have not observed any substantial increase in activity among cargo owners. They have also not noticed any indication of a sudden surge in volume. Additionally, there are no signs of capacity constraints or peak season surcharges on the horizon.

The seasonal lull combined with overall low demand had been pushing volumes below pre-pandemic levels at some of Europe’s major hubs. A slow Chinese economy, reduced industrial output, an ongoing surplus of inventory, and various other factors are collectively dampening demand for freight transportation and orders.

Consumers seem unlikely to sustain their previous years’ spending patterns due to inflation eroding their financial cushions and increased economic uncertainty prompting greater prudence. Earlier in the year, there were expectations of exciting product launches elevating the peak season, with Apple’s new iPhone being a potential contender. However, it has not gained the anticipated traction.

Airport operations are presently running without any issues. Hauliers are operating under regular conditions and there have been no flight cancellations. Furthermore, weather conditions have not caused any disruptions.

Brexit

The implementation of the red and green lane system under the Windsor Framework took effect on Sunday 1st October. Its primary aim is to minimise trade disruptions between Great Britain and Northern Ireland. From this date, goods destined for the Republic of Ireland or other European Union countries that arrive in Northern Ireland will need to adhere to the “red line” procedure. This involves customs declarations and certain inspections. However, goods intended to stay within Northern Ireland can take advantage of the “green lane” approach. This will significantly reduce paperwork requirements and avoid inspections. This streamlined process is made possible by distributors being registered with the “trusted trader” scheme.

Northern Ireland

Northern Ireland continues to lack a functioning government as the Democratic Unionist Party (DUP) withdrew its participation in protest to the post-Brexit trading arrangements for the region which were established by the protocol. Although the framework has been presented as a resolution to the problems arising from the protocol, the DUP argues that it does not adequately tackle their apprehensions. The party asserts that it will not participate in the government until Westminster offers additional reassurances regarding Northern Ireland’s status within the UK internal market. Prime Minister Rishi Sunak has indicated that while the framework can be applied with some flexibility, the core elements of the agreement remain unchanged.

However, the DUP has faced significant criticism. As many now believe that with the new Windsor Framework, Northern Ireland is in a highly advantageous position.

Despite the absence of local ministers, the responsibility of setting Northern Ireland’s budget for 2023/24 has fallen on the current Secretary of State for Northern Ireland, Chris Heaton-Harris. In addition, senior civil servants have taken on the task of managing departments in the region.

Meanwhile, the financial situation for Northern Ireland deteriorates further. Many civil servants have expressed the need for substantial additional funding. This amounts to hundreds of millions of pounds, to sustain public services at their present level.

Commodity Rates

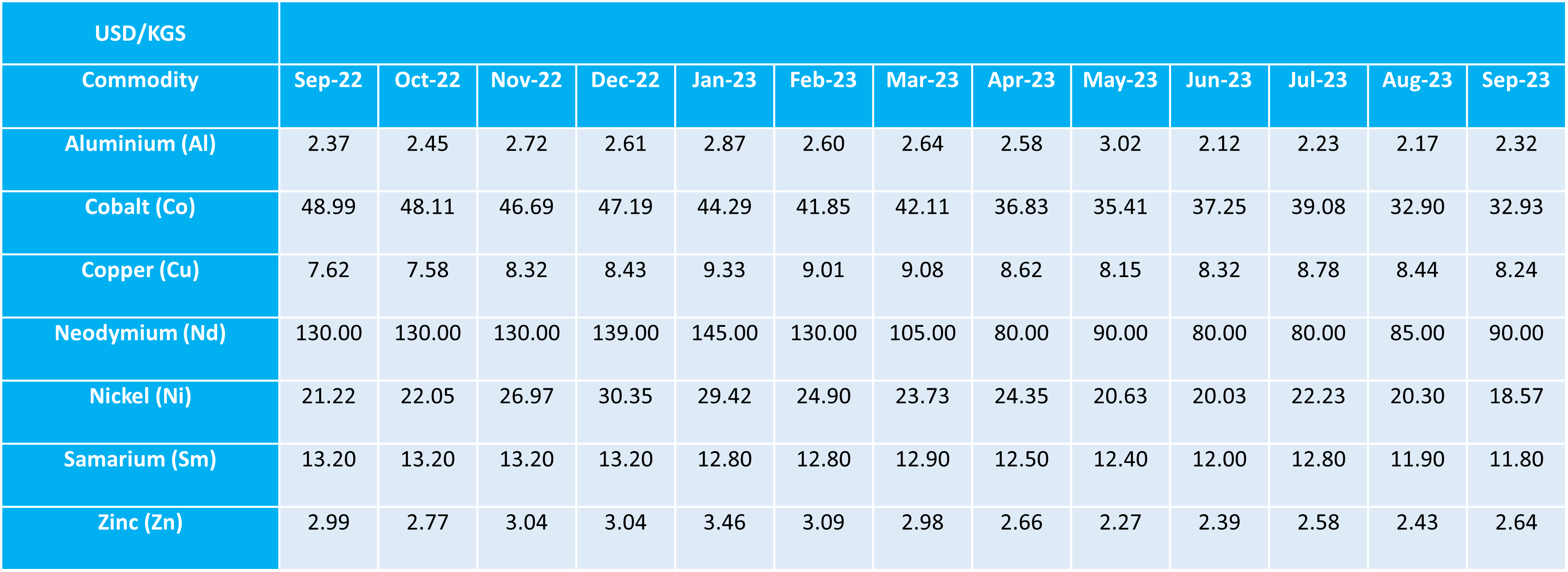

In September, the global commodity market experienced noteworthy shifts in metal rates. Aluminium’s value edged up by 0.15 USD/KGS, and Cobalt, an essential component in various industries, also saw an increase, albeit a minor one of 0.03 USD/KGS. Neodymium, vital for its role in high-tech applications, emerged as the month’s standout, with its rate soaring by an impressive 5 USD/KGS. Zinc wasn’t far behind, marking an increase of 0.21 USD/KGS. Conversely, Copper’s value receded by 0.20 USD/KGS. Nickel, integral to stainless steel production and rechargeable batteries, underwent a significant decline, dropping by 1.73 USD/KGS. Samarium, another member of the rare earth metals family, also witnessed a decrease of 0.10 USD/KGS.

Our vigilant tracking ensures that our customers remain well-informed, enabling them to make strategic decisions in an ever-evolving market landscape.

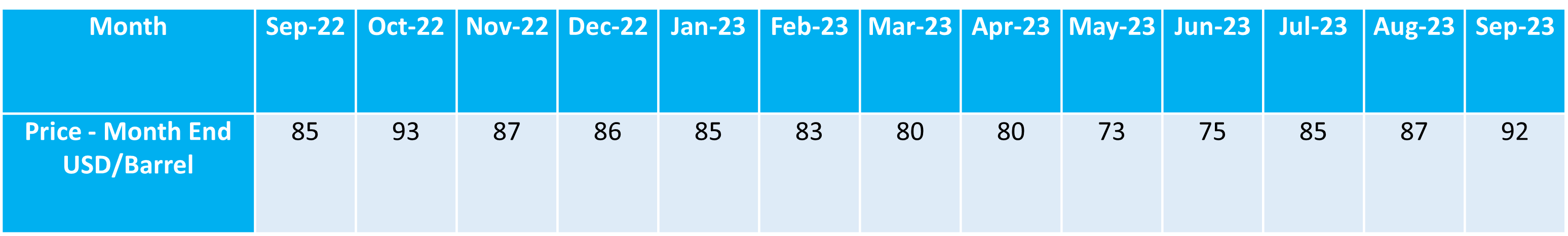

In the month end of September, the global energy market saw a notable surge in the price of Brent crude oil, a benchmark for worldwide oil prices. This essential commodity experienced a significant increase of $5 USD/Barrel, drawing the attention of traders, investors, and industry experts. The rise in Brent crude oil prices often serves as an indicator of global economic health and energy demand. As such, this uptick underscores the importance for businesses to keep a close watch on Brent crude oil trends. Ensuring they remain well-informed and can adjust their strategies accordingly in the dynamic world of energy trading.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity. Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.